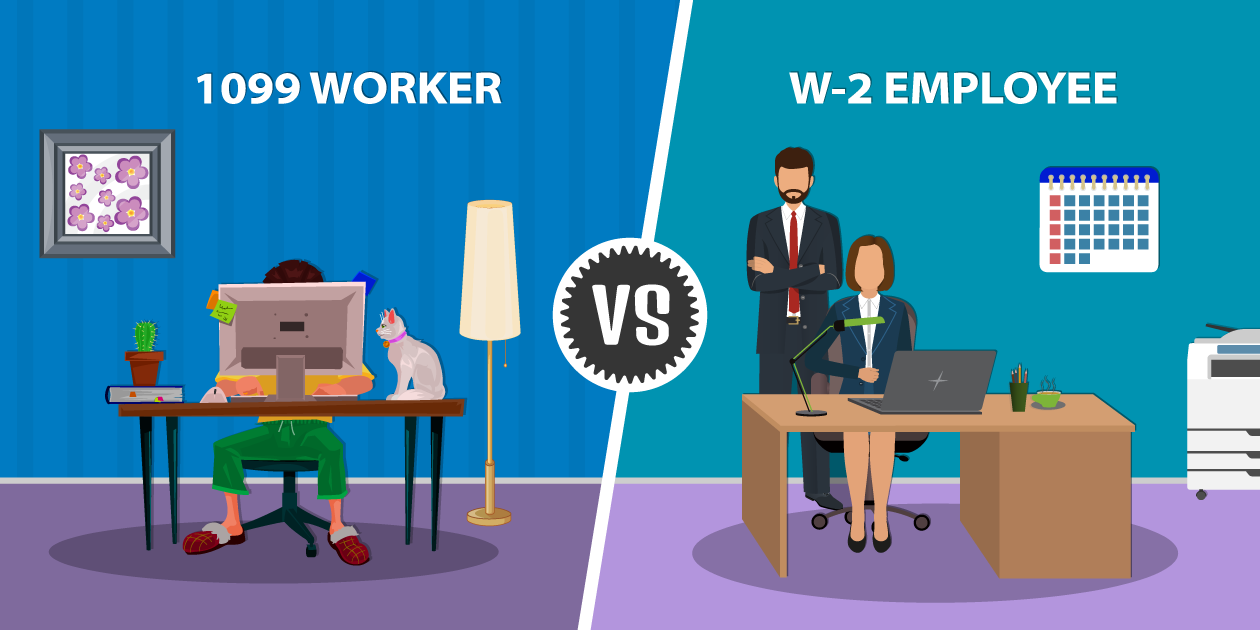

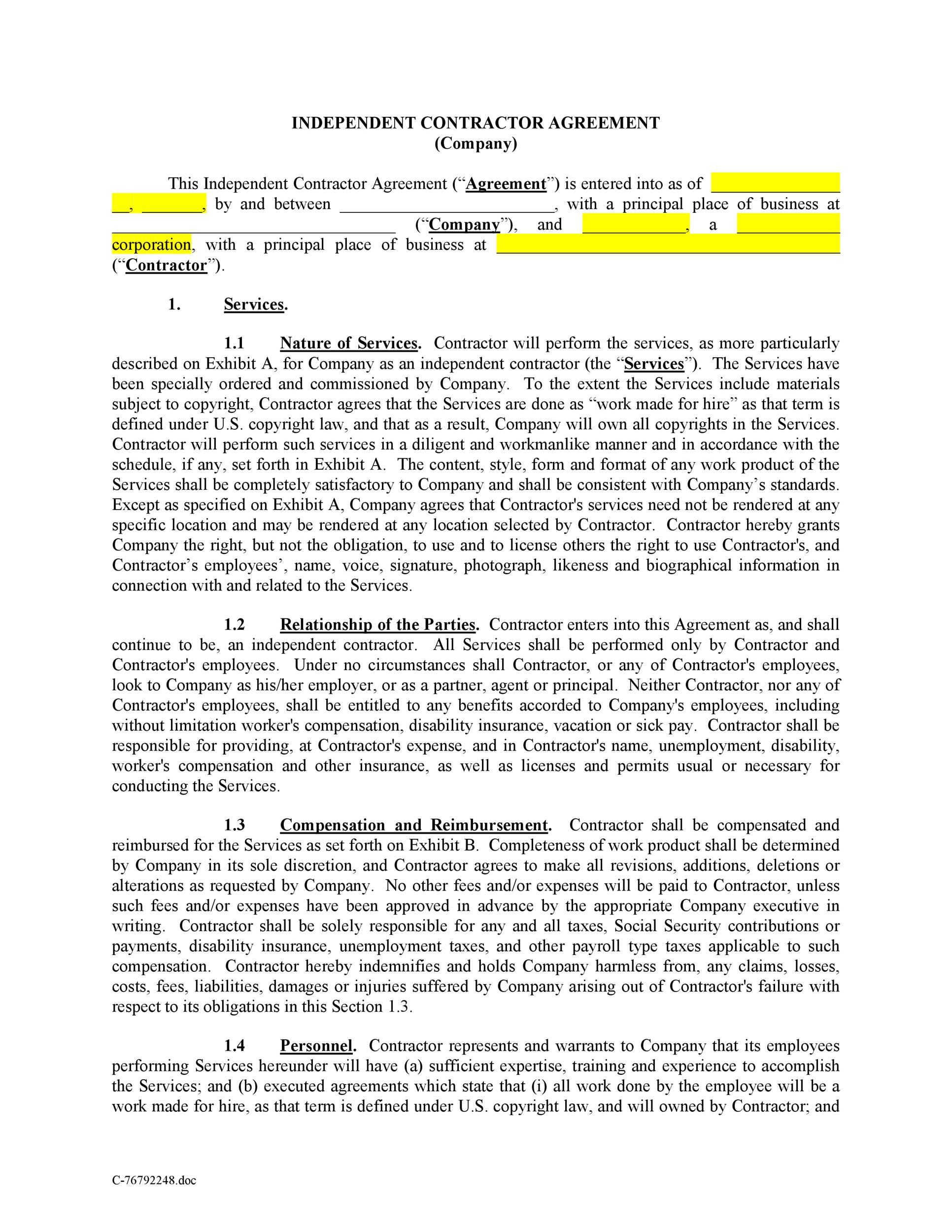

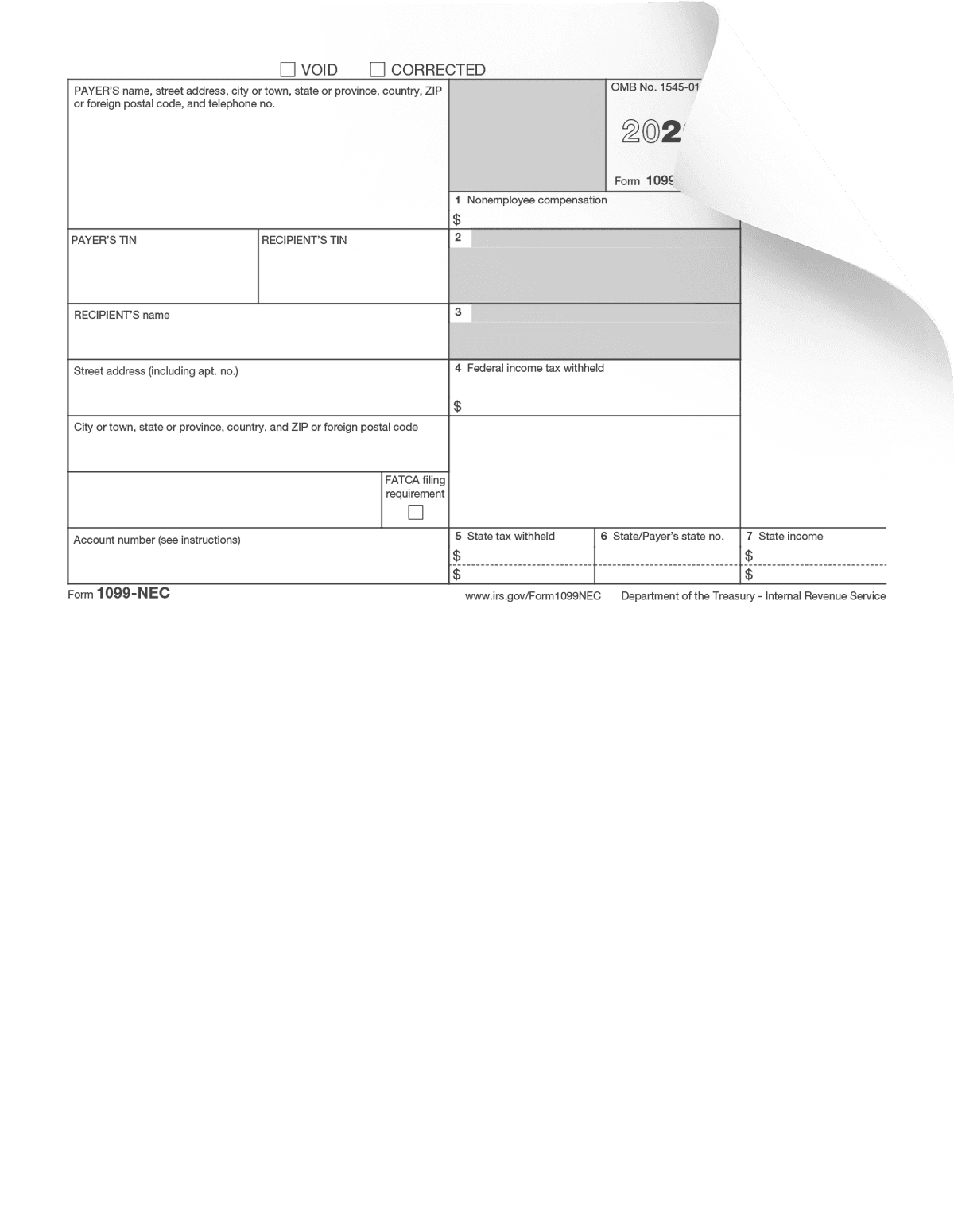

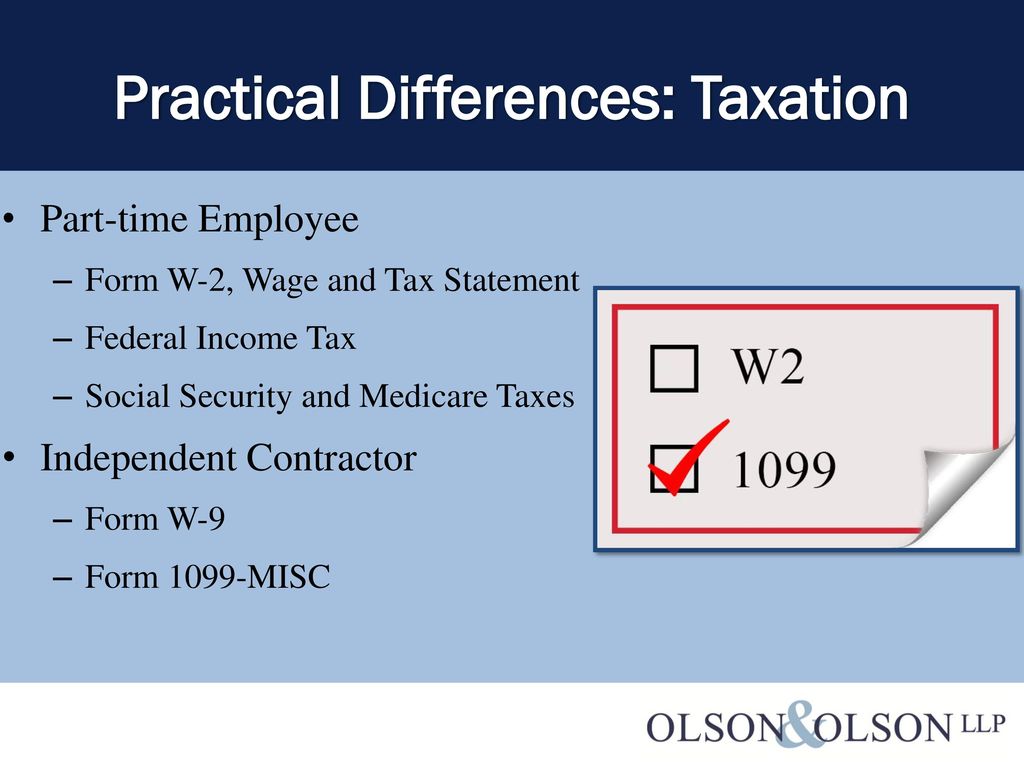

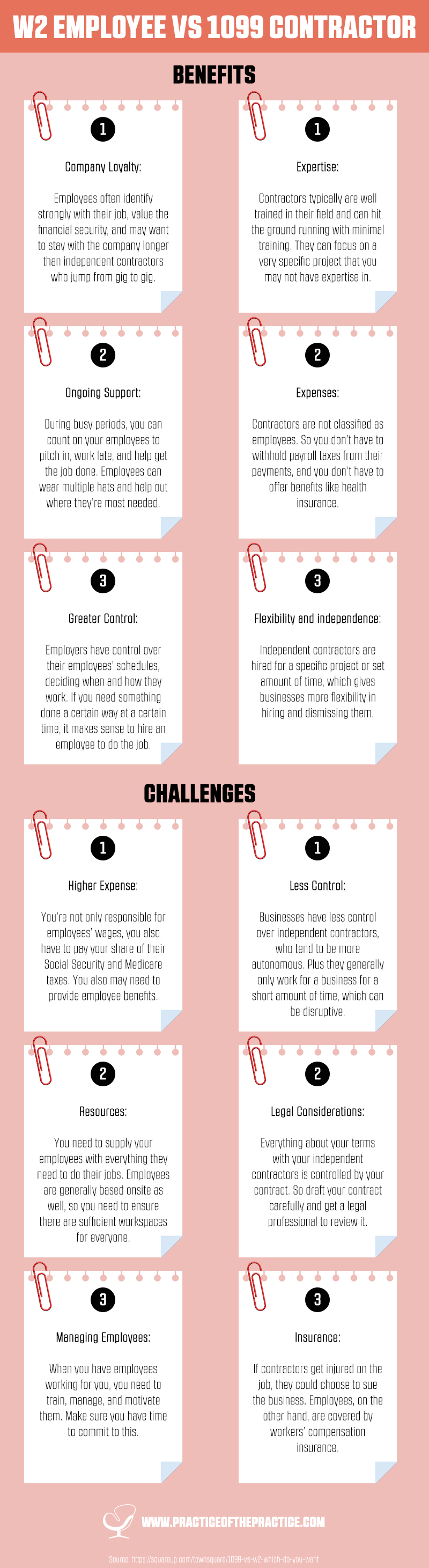

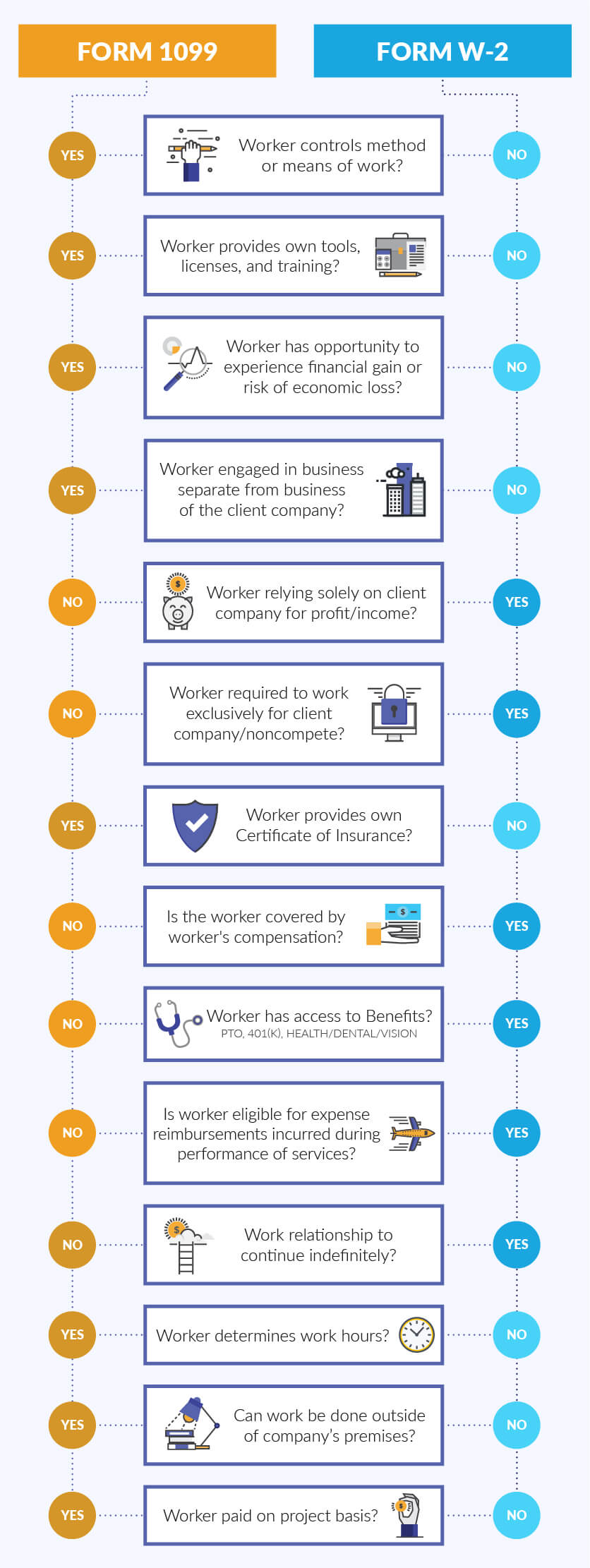

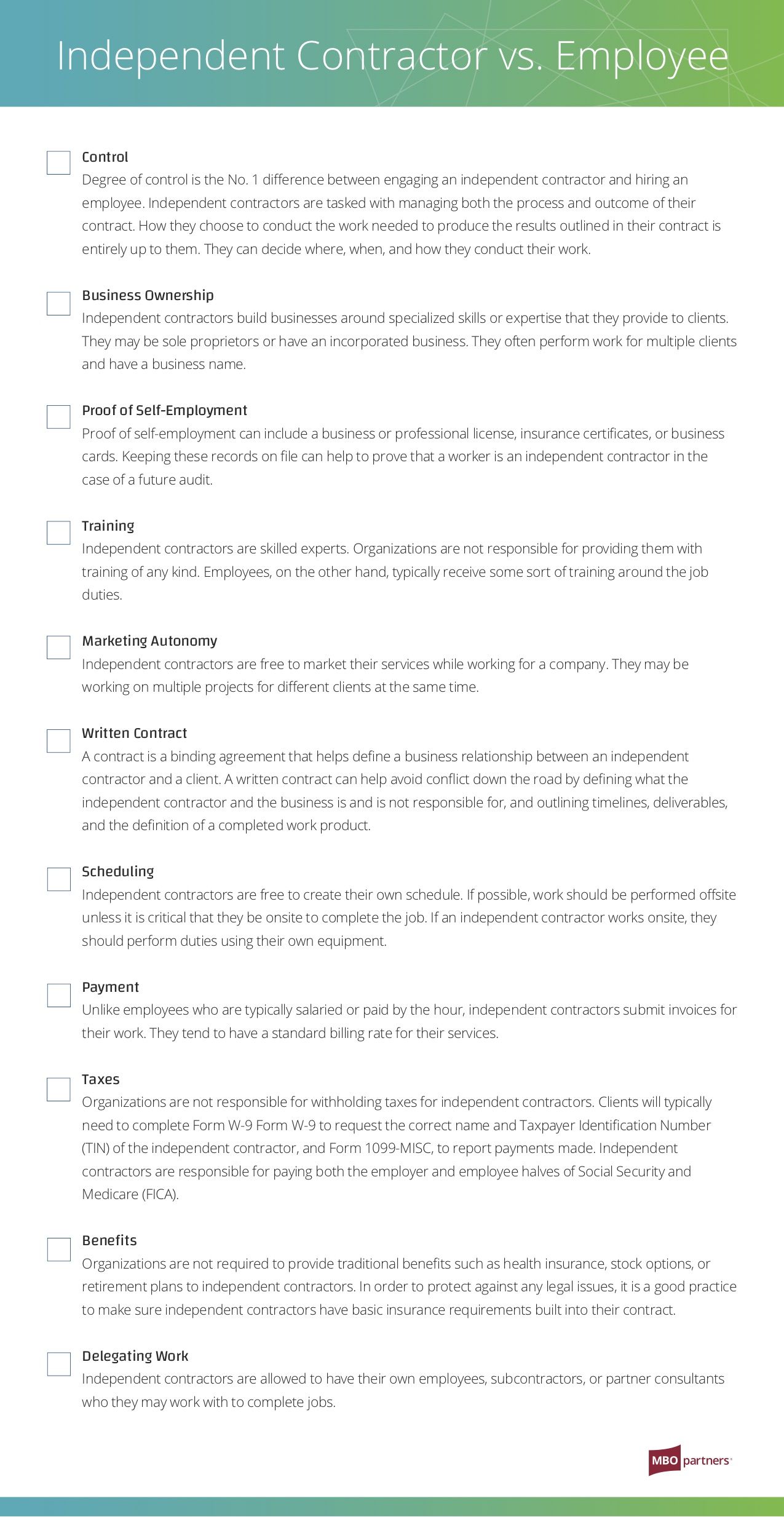

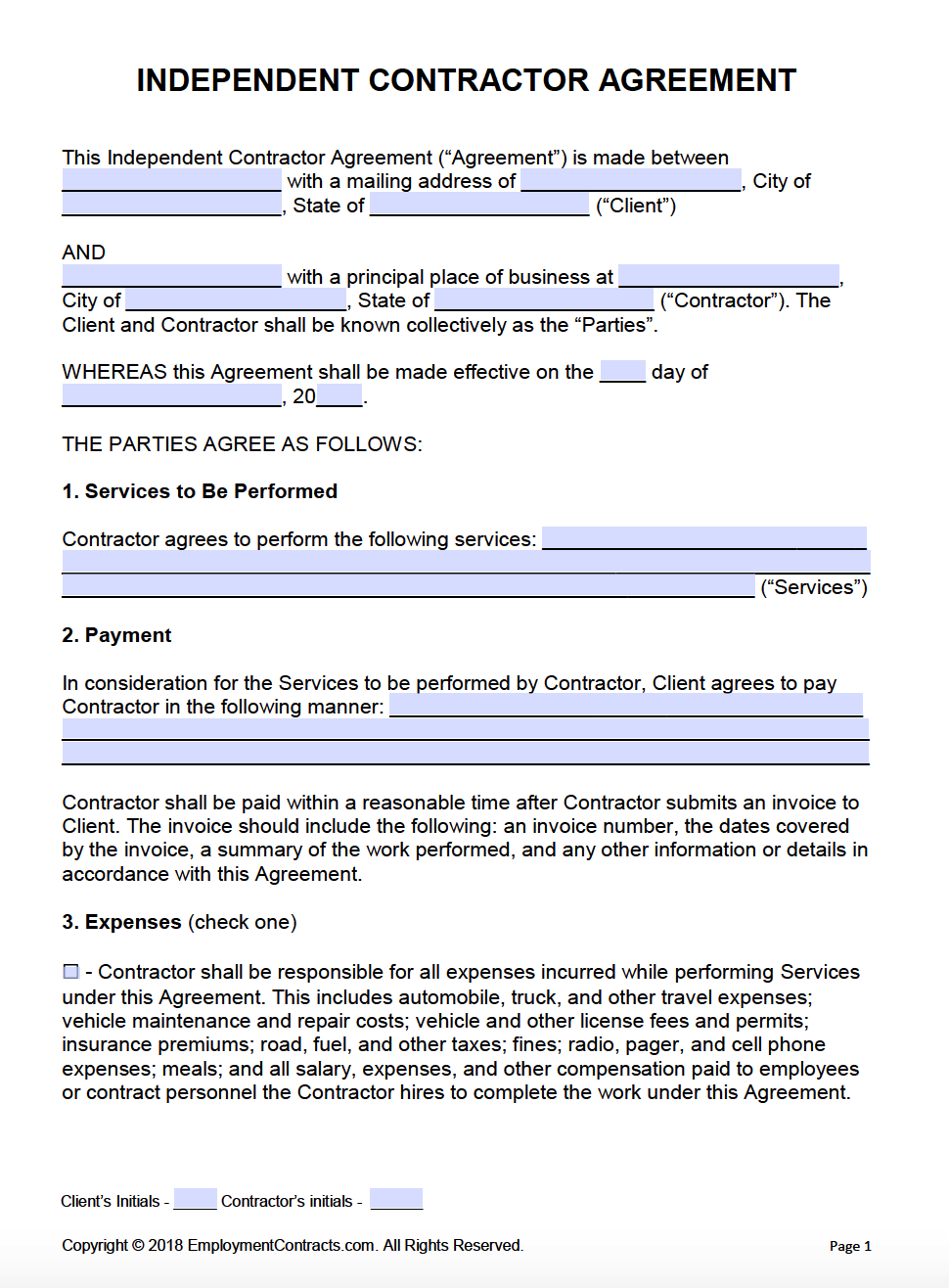

If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC You may simply perform services as a nonemployee For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor They waive any rights as an employee When you hire workers, you must determine their classification – either as an employee within your company or an independent contractor – as you will be required to file either IRS Form W2 or IRS Form 1099MISC for them The difference may not seem paramount, but Mark W Everson, vice chairman of alliantgroup and former IRS commissioner

W 9 Vs 1099 Understanding The Difference

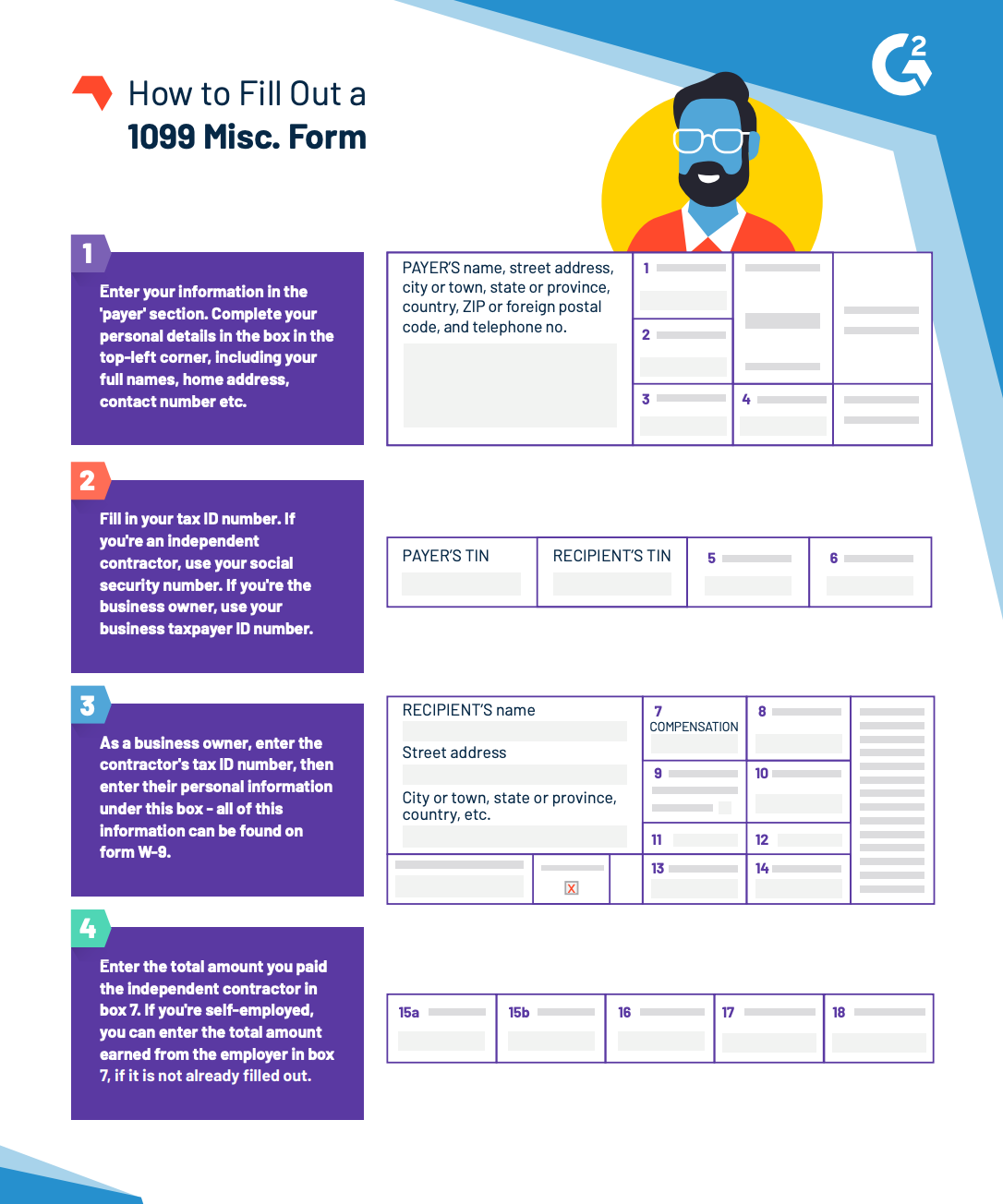

How to 1099 an independent contractor

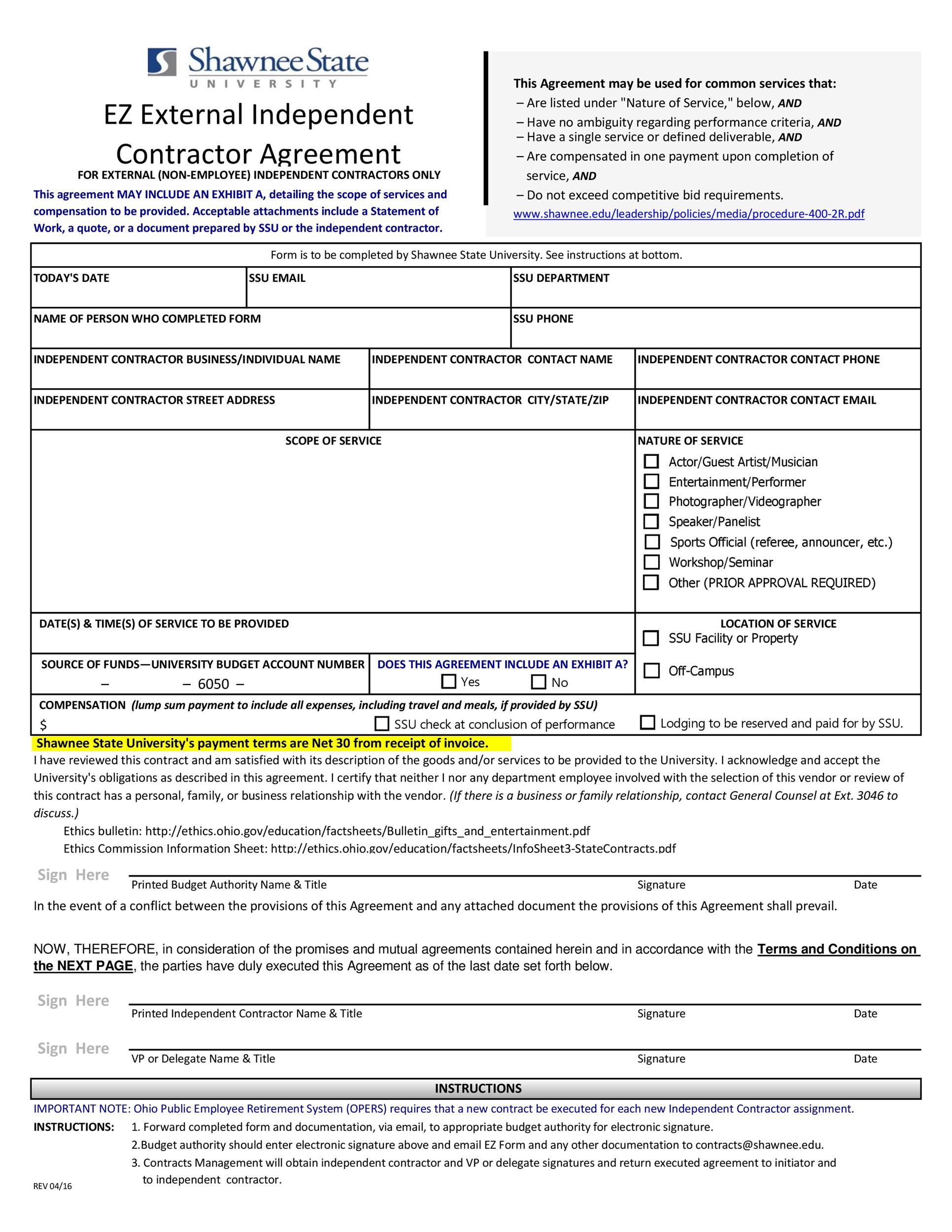

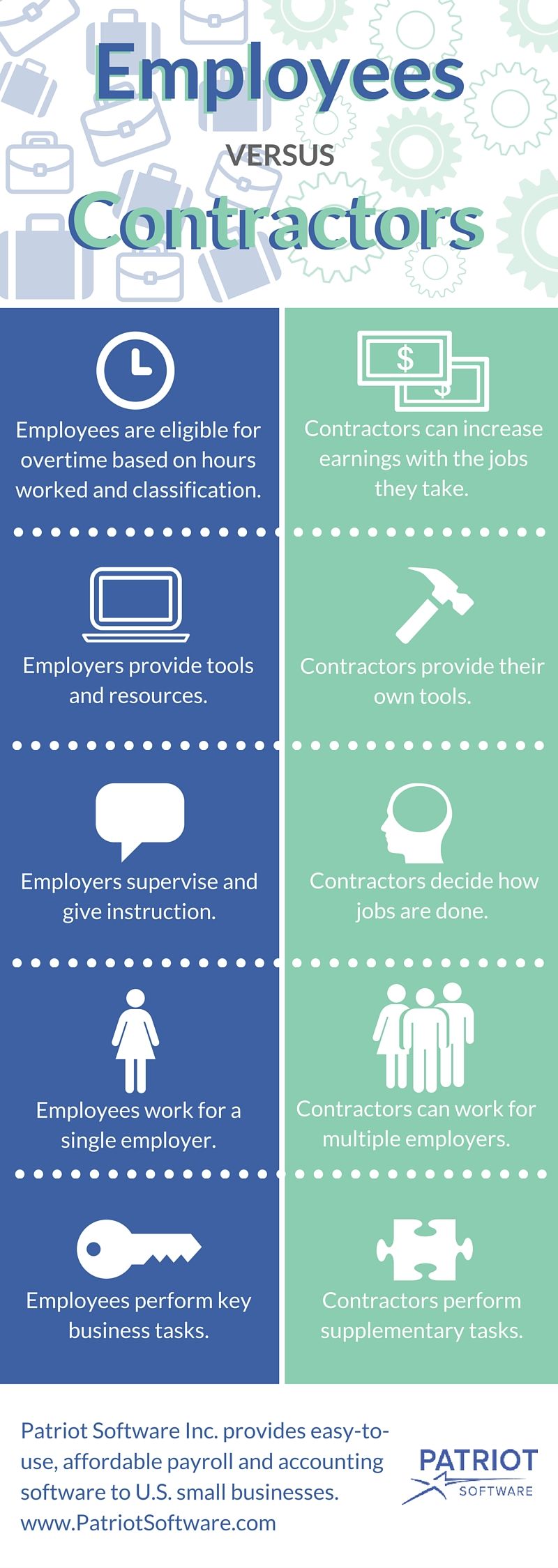

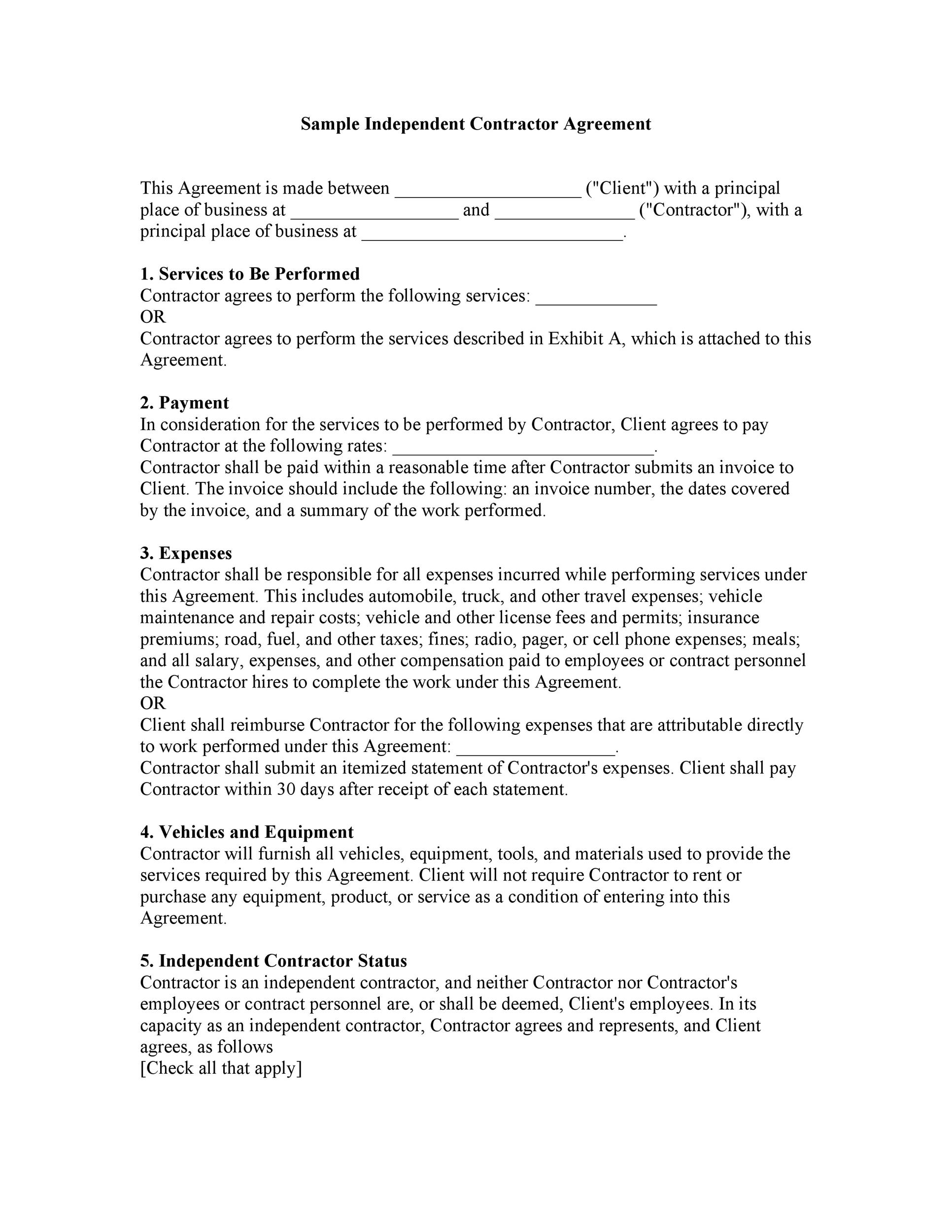

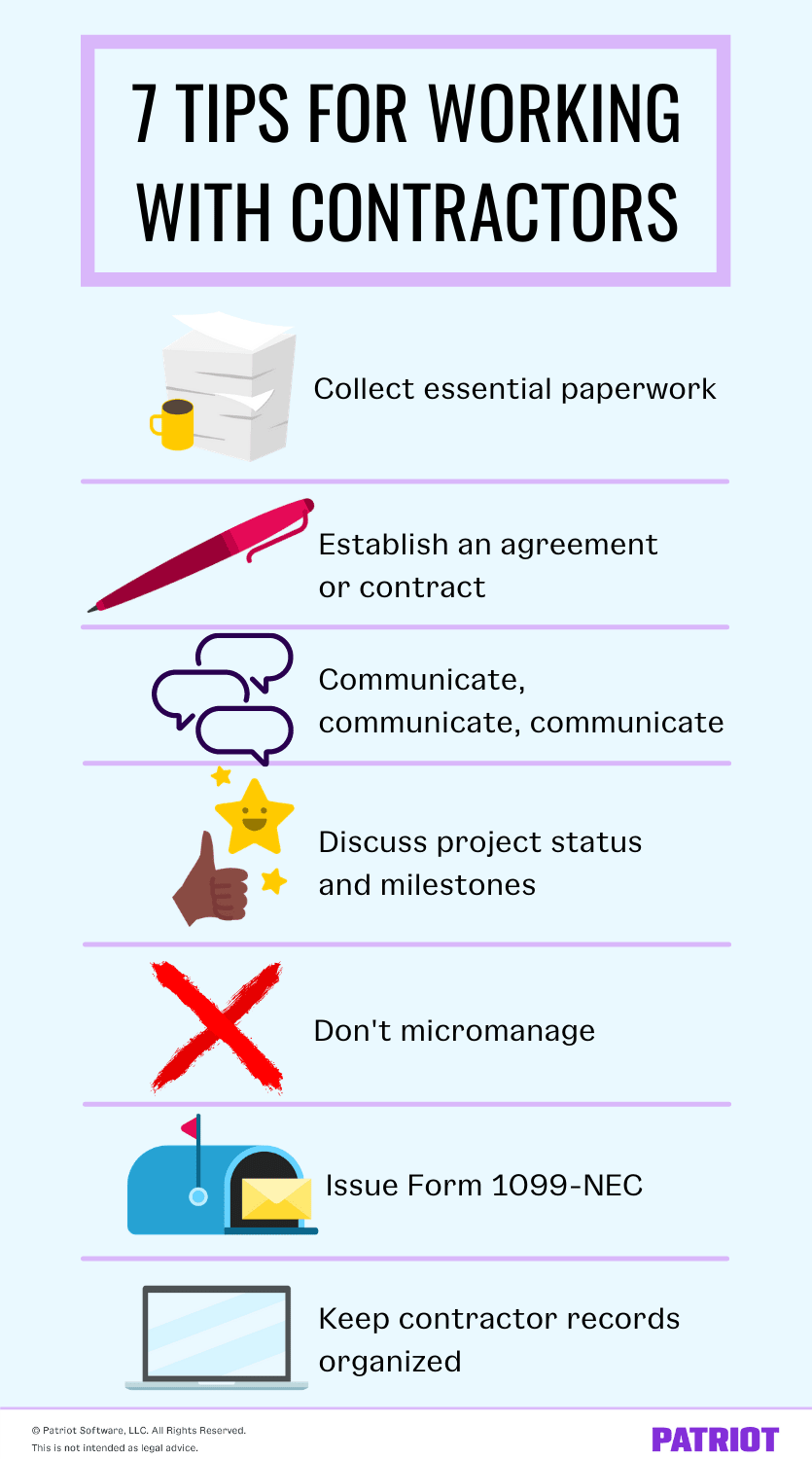

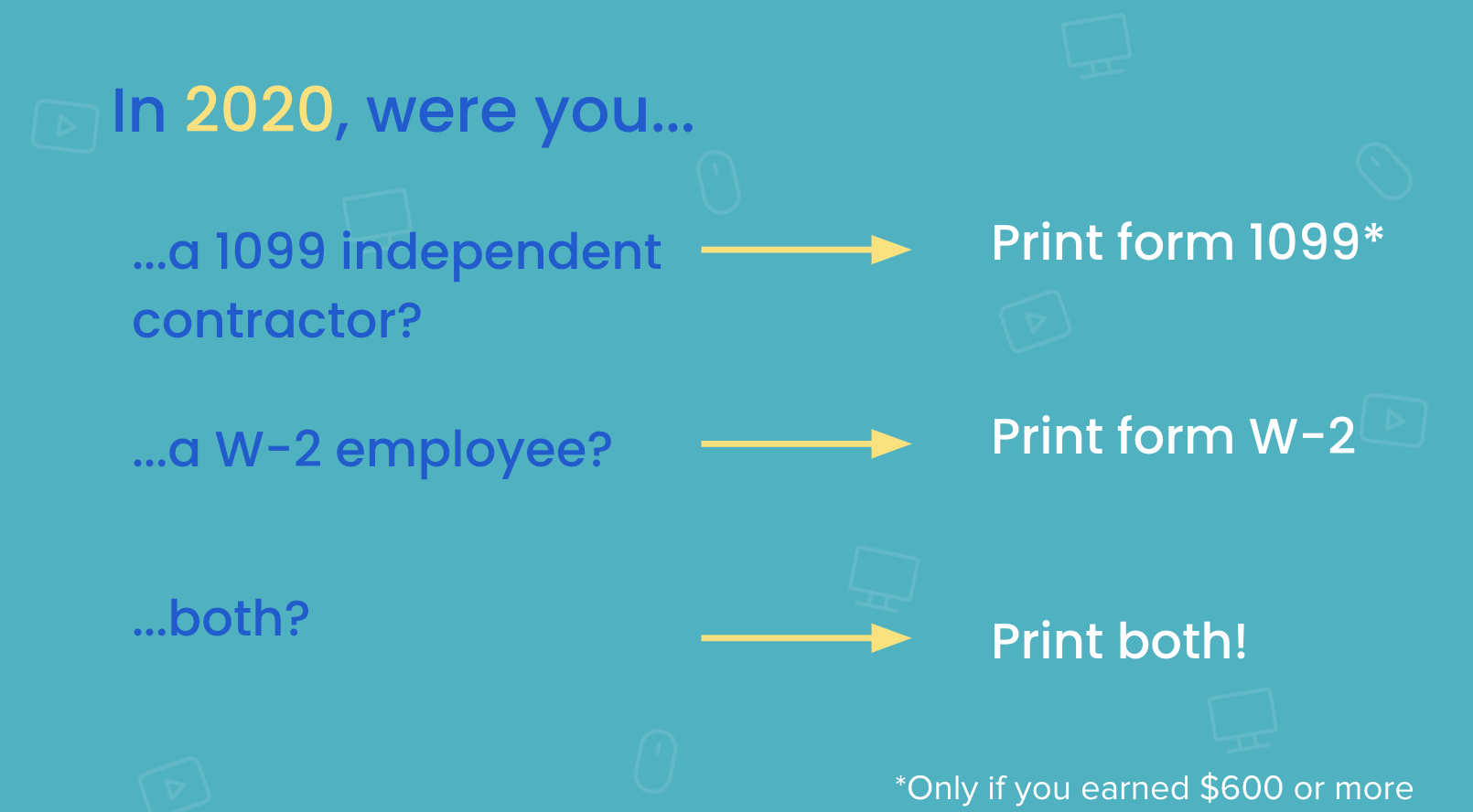

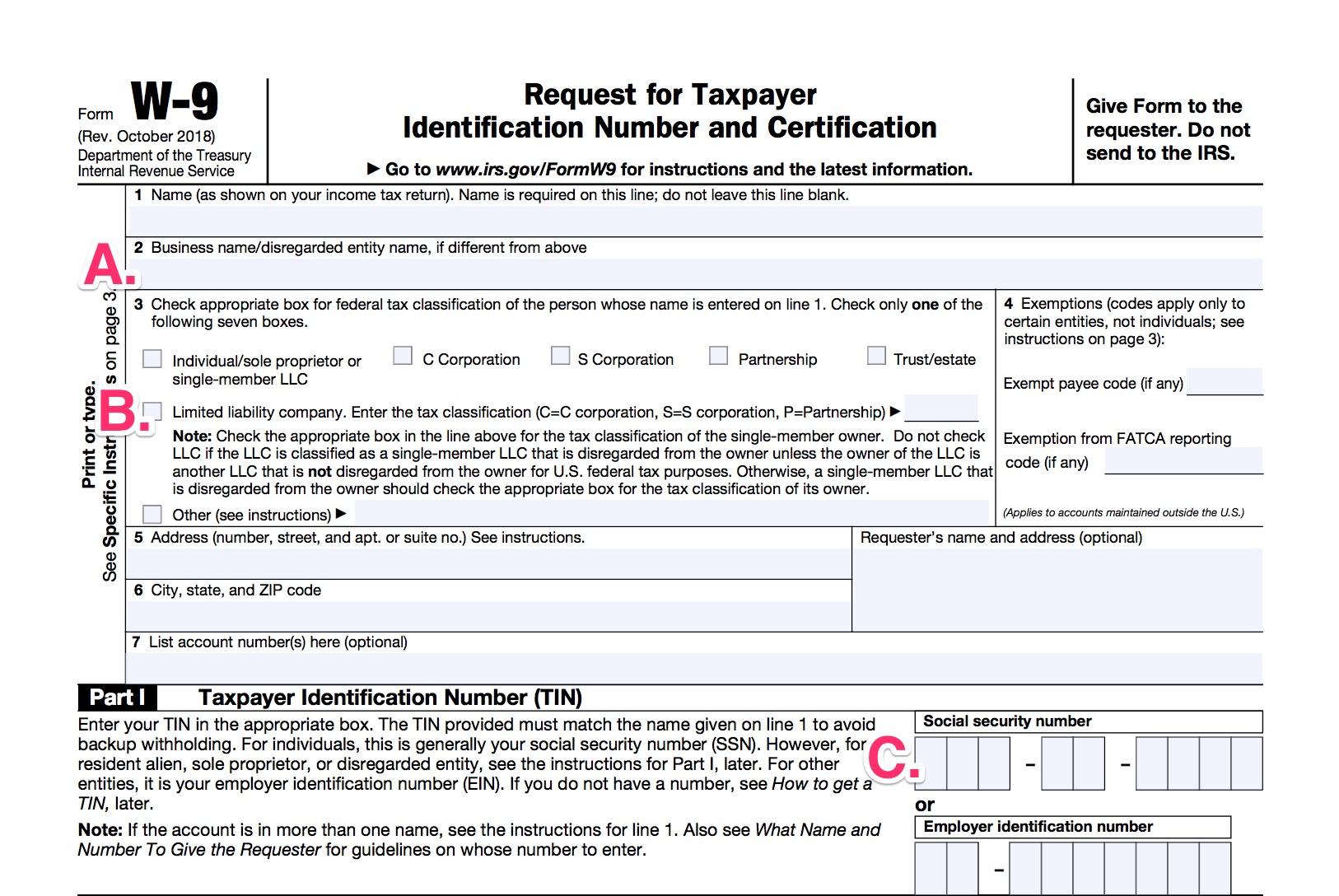

How to 1099 an independent contractor-If you hire 1099 workers directly, rather than through an employment agency, you will need to set up the following IRS paperwork W9 form 1099NEC form Assuming you pay your contractor more than $600 in any calendar year, you will need to send a copy of the 1099NEC to the contractor and the IRS by January 311099 vs W2 How Independent Contractors and Employees Differ An employee performs work for you under your direct or indirect supervision, during hours that you specify and conditions you control You also withhold payroll taxes from the wages you pay him or her

Laser Set 2 Up 1099 Misc 4 Part Hrdirect

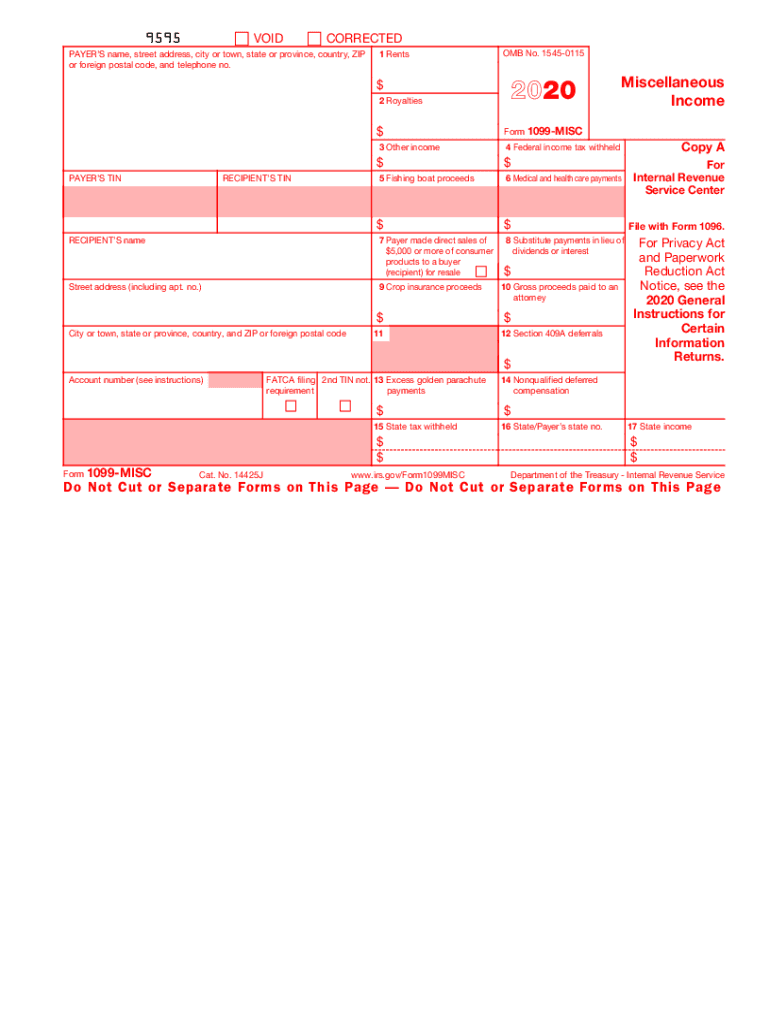

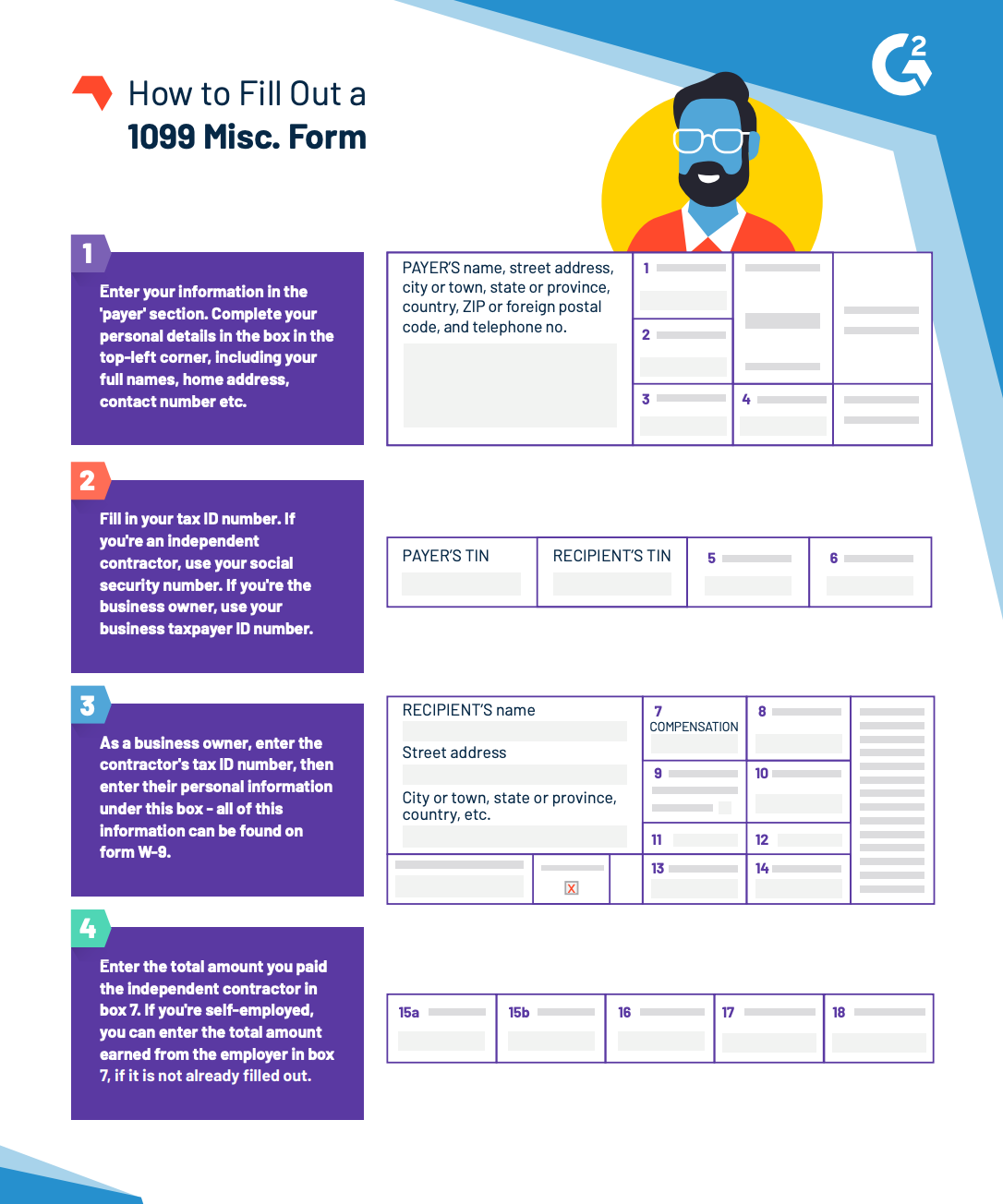

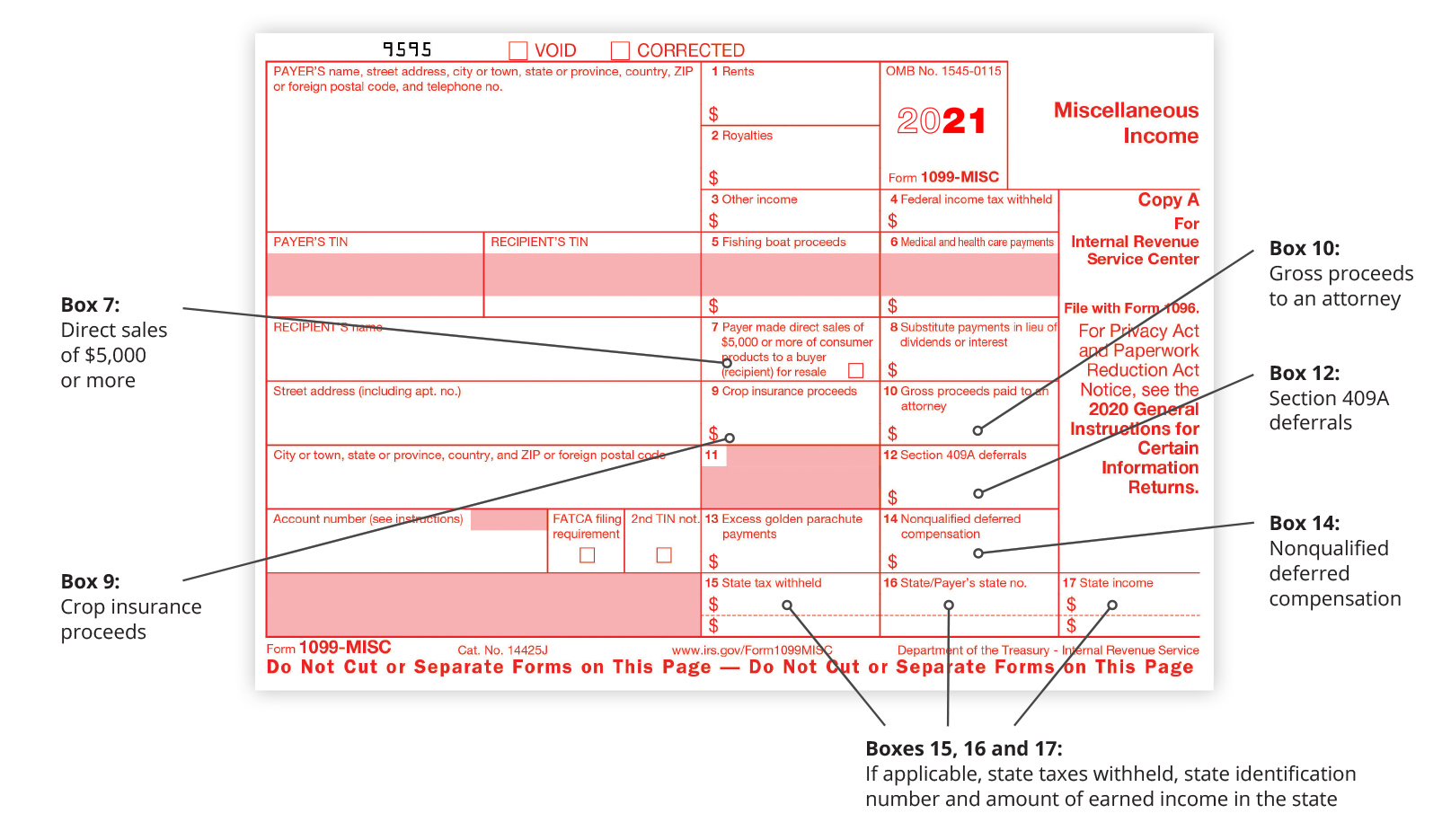

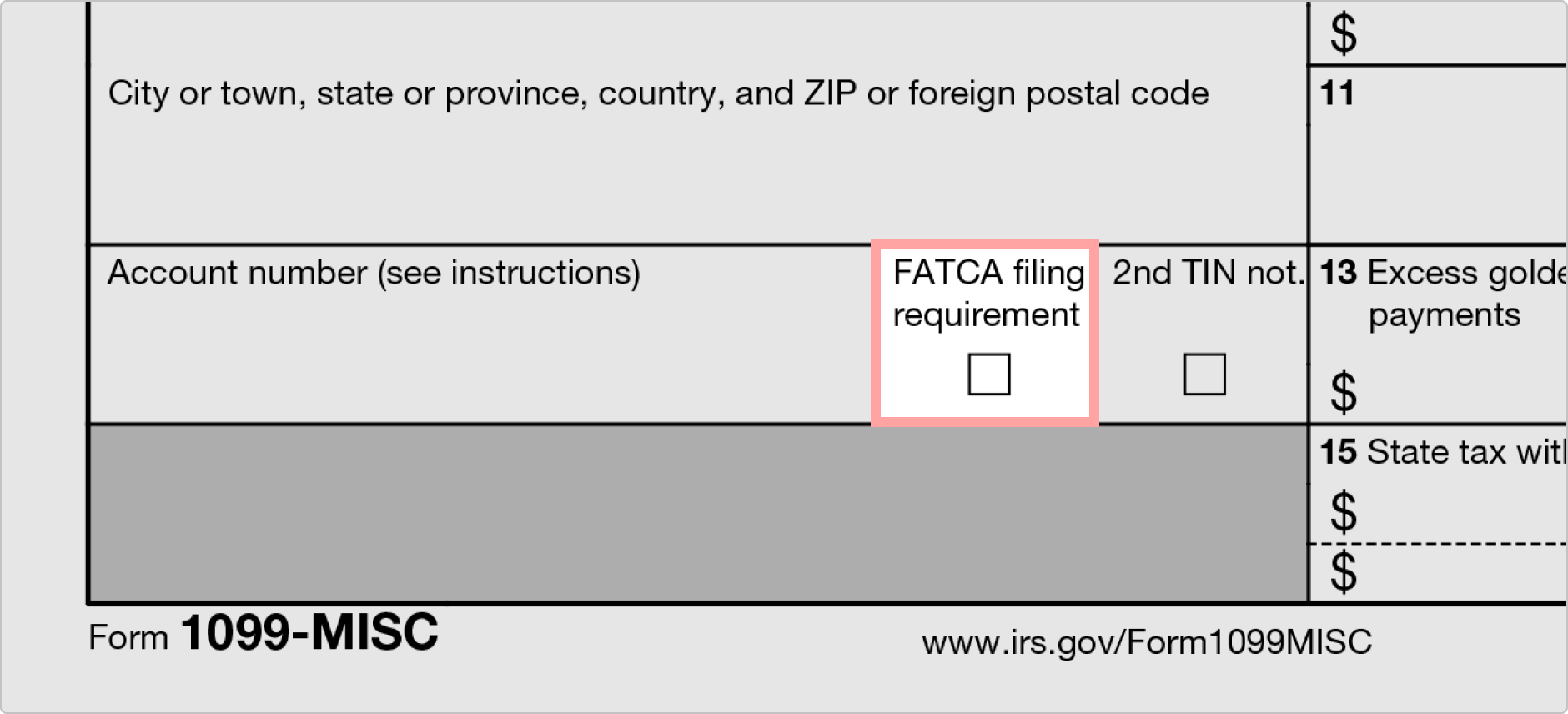

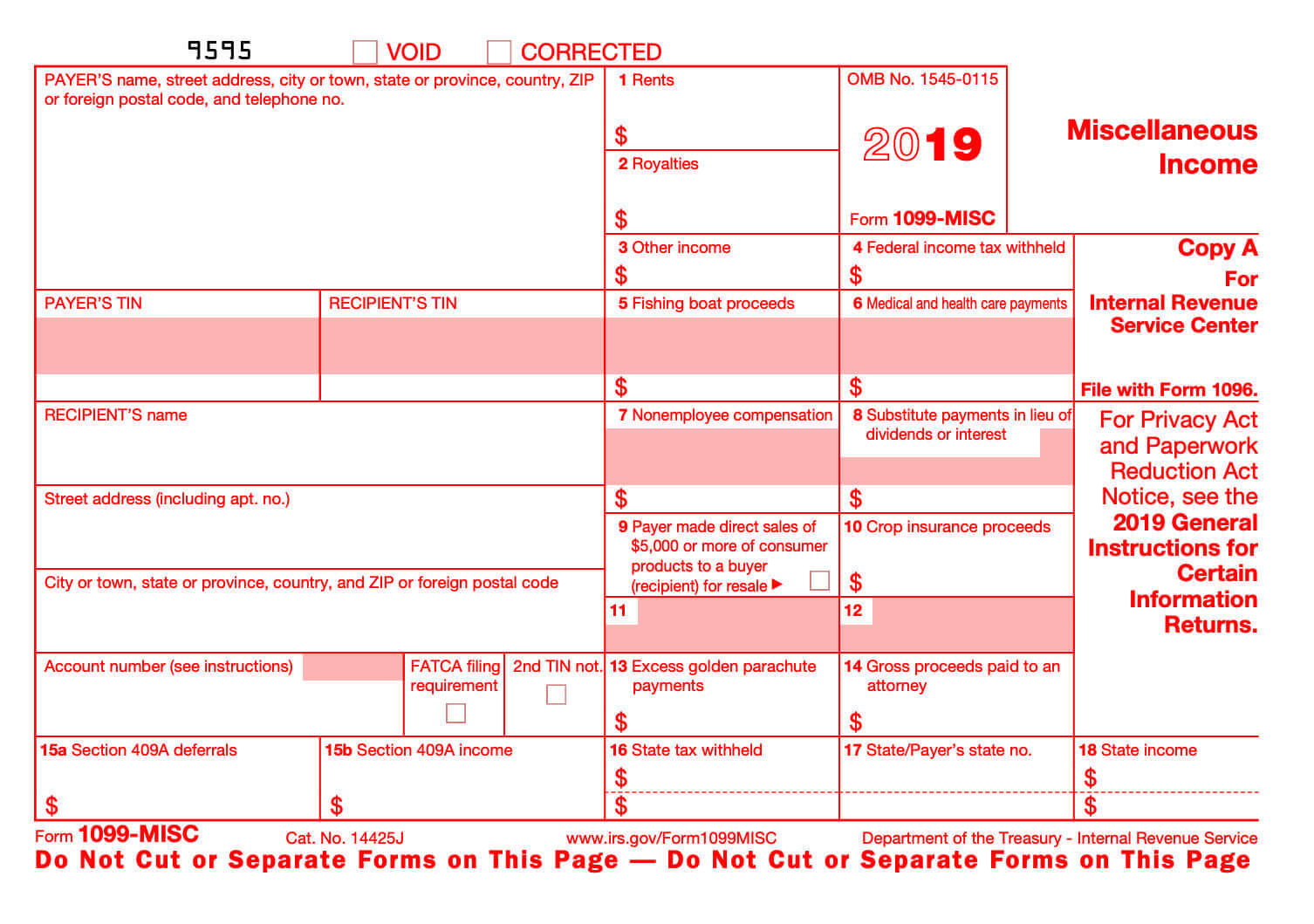

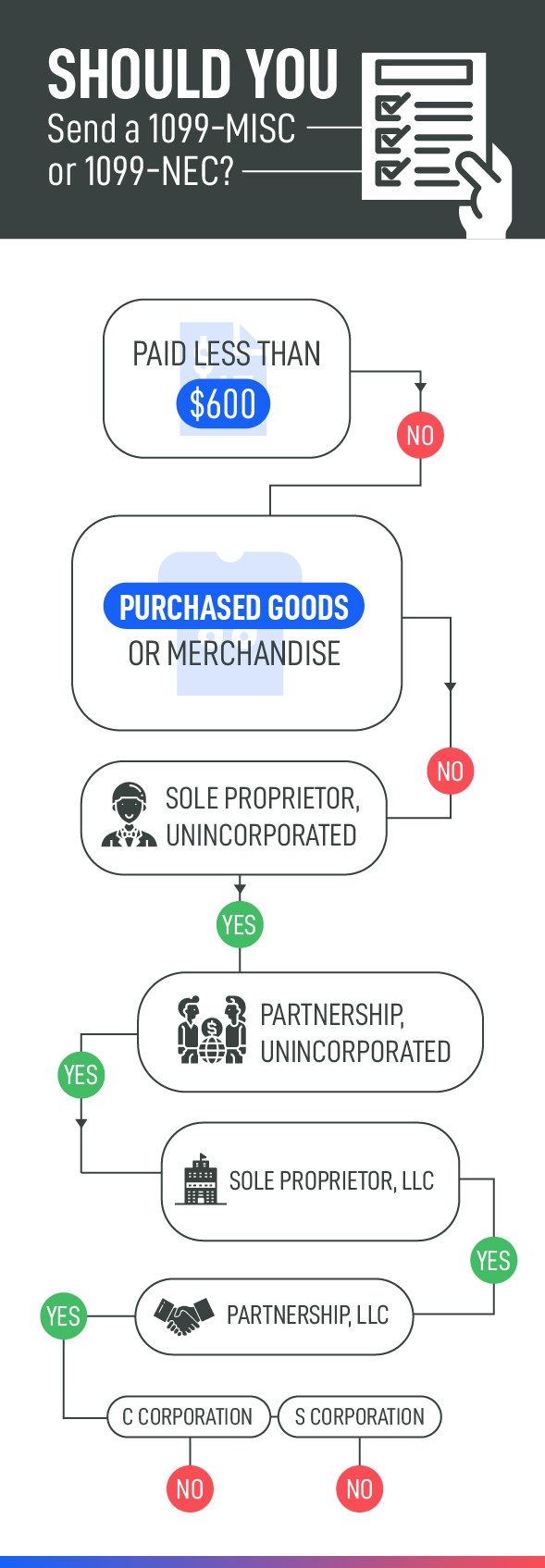

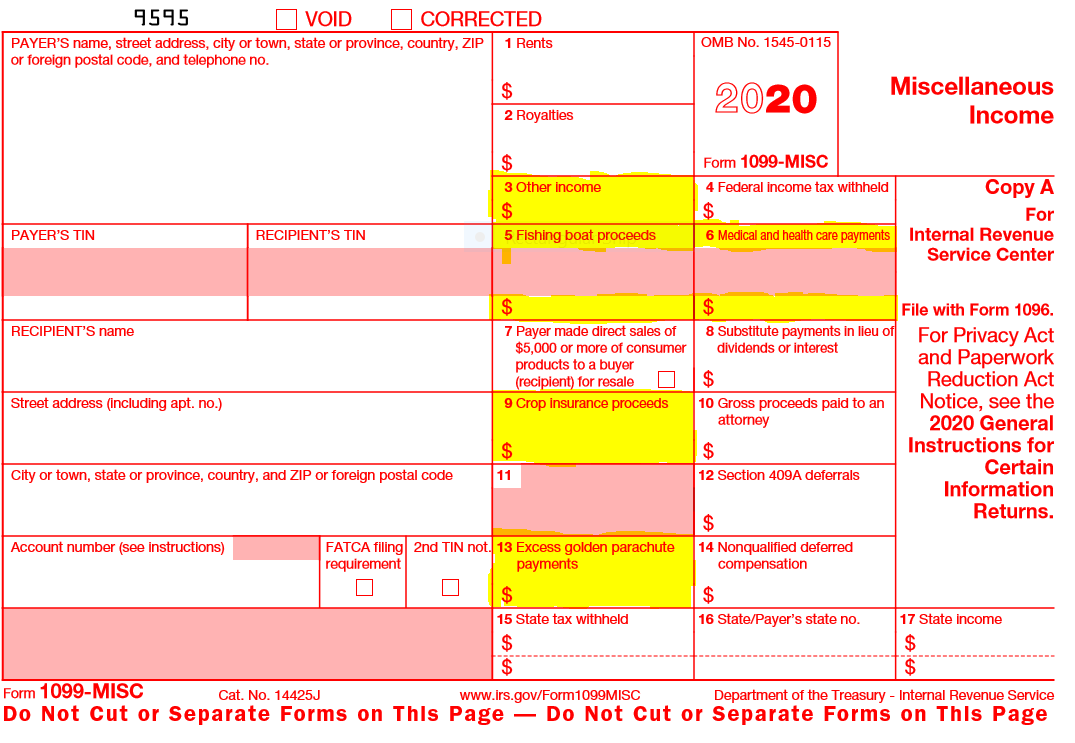

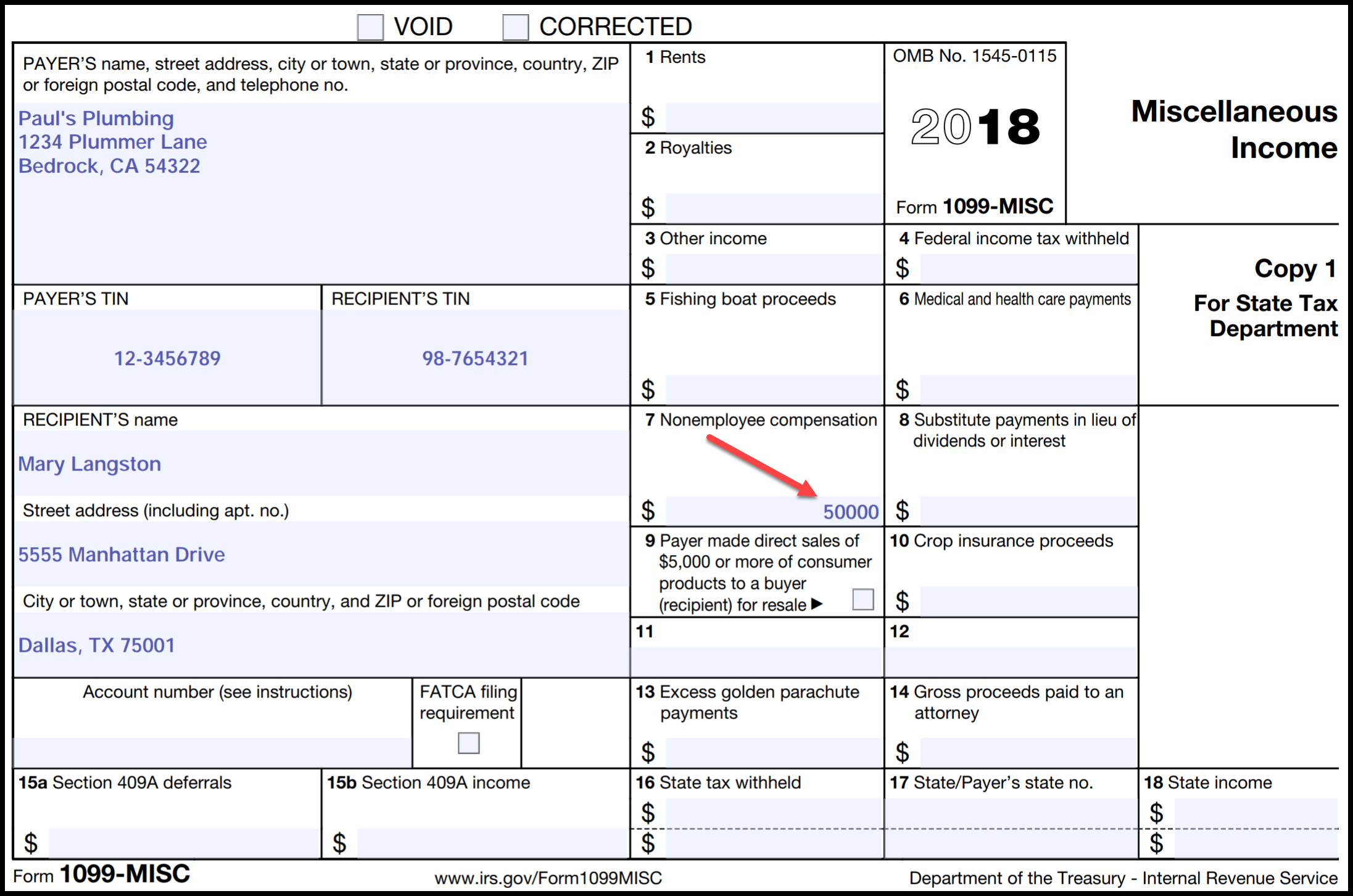

Independent contractor tax forms When tax time rolls around, if you earned $400 or more during the year, you'll need to file a tax return using the forms listed below In some situations, you might also be required to file a tax return even if your net income was less than $400 1099 contractor form1099MISC forms go to independent contractors, partnerships and other entities with whom you contract for services, among others The IRS has extensive guidance on Form 1099NEC reports nonemployee compensation to independent contractors As of tax year , the 1099MISC is no longer used to report payments to contractors However, business owners need to understand when the 1099MISC form should be issued Important requirements for 1099MISC forms

The 1099NEC reports how much an independent contractor earned (but not including payments made via credit cards or third party settlement platforms) while working with you Both you and your contractor will need it to fill out your taxes Every 1099NEC comes with a Copy A and a Copy BEmployees and Independent Contractors have completely different forms to submit In a previous post, we talked about the differences between an employee and independent contractor Now, let's talk about the forms Keep all invoices on file, and make sure they coordinate with Form 1099MISC Independent Contractor vs Employee If you are not sure whether the individual is an employee or an independent contractor, the IRS, US Department of Labor, your State Compensation Board,

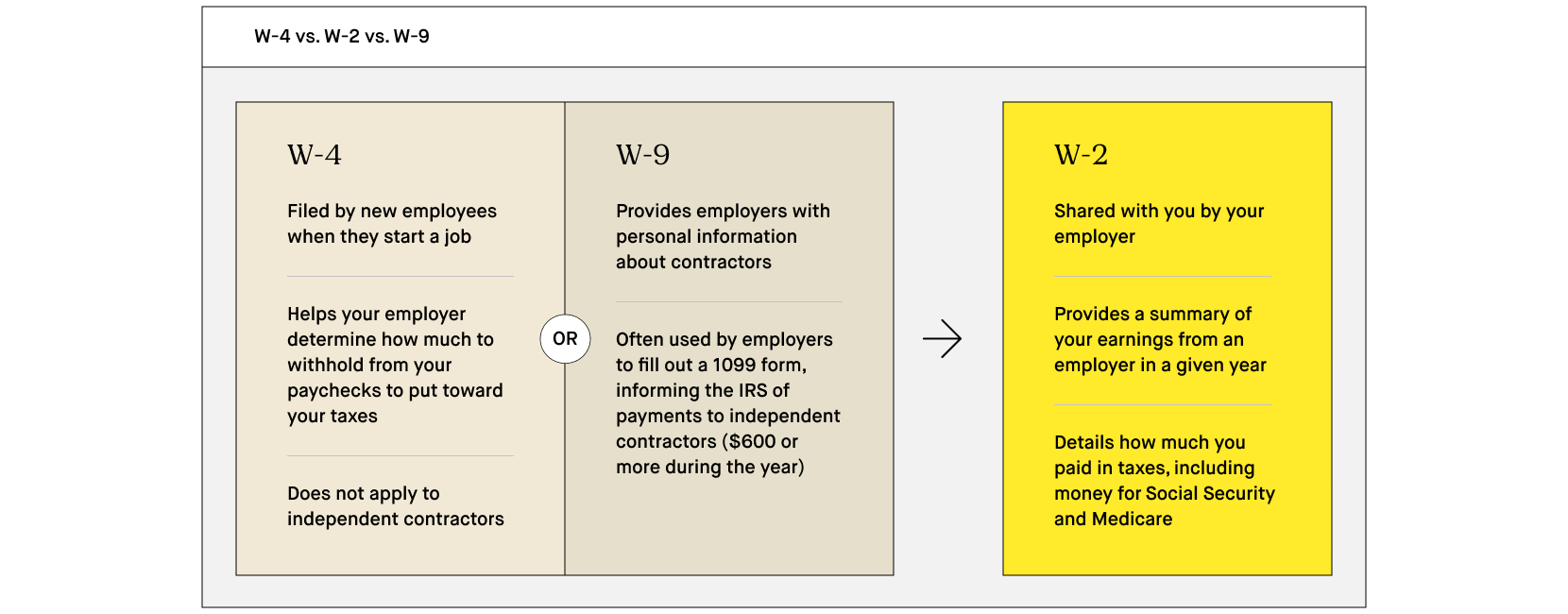

An Evangelist, guest speaker, or guest psalmist is considered a contractor, but a Pastor is an employee 1099's are income reporting forms for Contractors, but not for employees The Pastor is not the only employee of a Church Simply put, 1099s and W2s are two separate tax forms for two different types of workers If you're an independent contractor, you get a 1099 form If you're an employee, you receive a W2 As a W2 employee, payroll taxes are automatically deducted from your paycheck and then paid to the government through your employerIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter

1099 Misc Tax Form Diy Guide Zipbooks

Http Www Aesi Com Wp Content Uploads 16 01 Risks With 1099s Pdf

Statement by an individual that he or she is an "independent contractor" issuance of a Federal Form 1099 A written agreement between a worker and the business does not control the worker's status Pennsylvania's UC Law requires an examination of the facts to determine if the worker is a legitimate independent contractorWhat is Form 1099? IRS Tax Form 1099NEC As of the tax year, the IRS Form 1099NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income

Galachoruses Org Sites Default Files Irs Questions W2 Vs 1099 Pdf

Independent Contractor Vs Employee What S The Difference Bench Accounting

New IRS Rules for 1099 Independent Contractors Along with all the other changes we have dealt with in , the IRS has also changed how organizations report the money paid to independent contractors, or as they prefer to label it, Nonemployee Compensation In past years, if your organization paid a person for services who was NOT an employee, you may To be clear "1099 workers" are not employees 1099 is a tax form for independent contractors, and independent contracts are not employees If you've heard the phrase "1099 employee," it is an oxymoron–there are no 1099 employeesIf you've paid a nonemployee over $600, you need to send them a 1099 form Note that as of , you need to send a 1099NEC instead of Form 1099MISC Pros and Cons Comparing 1099 Workers and W2 Employees Hiring a 1099 worker can save a business owner a lot of money when it comes to payroll taxes and employee benefits

Irs Form 1099 Nec And 1099 Misc Rules And Exceptions

Independent Contractor Vs Employee What S The Difference

The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the formsEmployees or Independent Contractor Use different forms 1099, W9, W4, W2 Oh my!Form 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due Date Form 1099 Reported Online to the IRS by the Payer or Issuer Issue a Form 1099 to a Payee, Contractor or the IRS

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Instant Form 1099 Generator Create 1099 Easily Form Pros

Employee or Independent Contractor A worker is considered to be an employee unless proven otherwise To be an independent contractor both of the following must be shown to the satisfaction of the department The individual has been and will continue to be free from control or direction over the performance of the services involved, both under the contract of service andEmployers and workers should file Form SS8 (Determination of Employee Work Status for Purposes of Federal Employment Taxes and Income Tax Withholding) to get a determination from the IRS as to whether or not a worker is an independent contractor Posted on Employees report their income on W2 forms Independent contractors use 1099 forms In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W2 form are employees Payroll taxes from W2 employees are automatically withheld, while independent

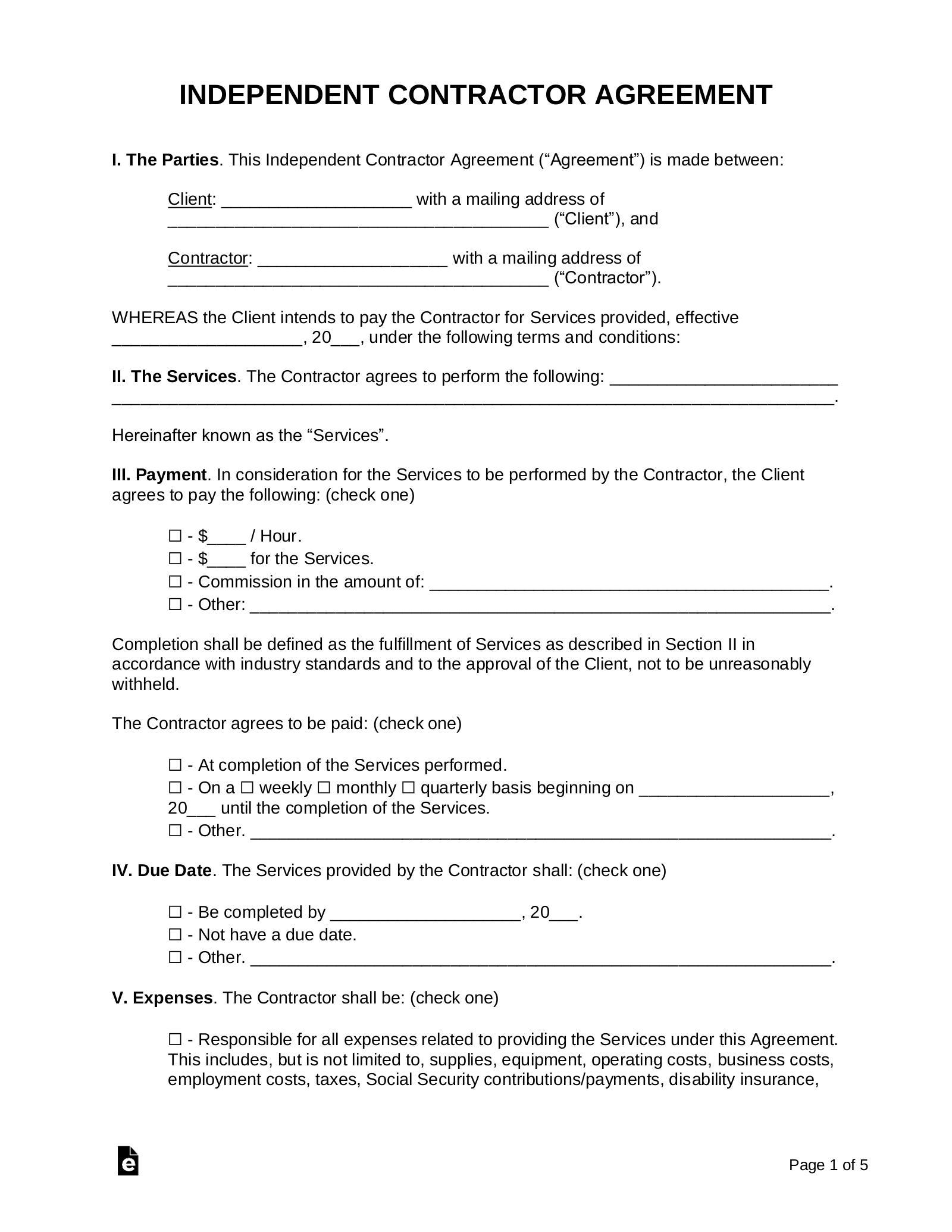

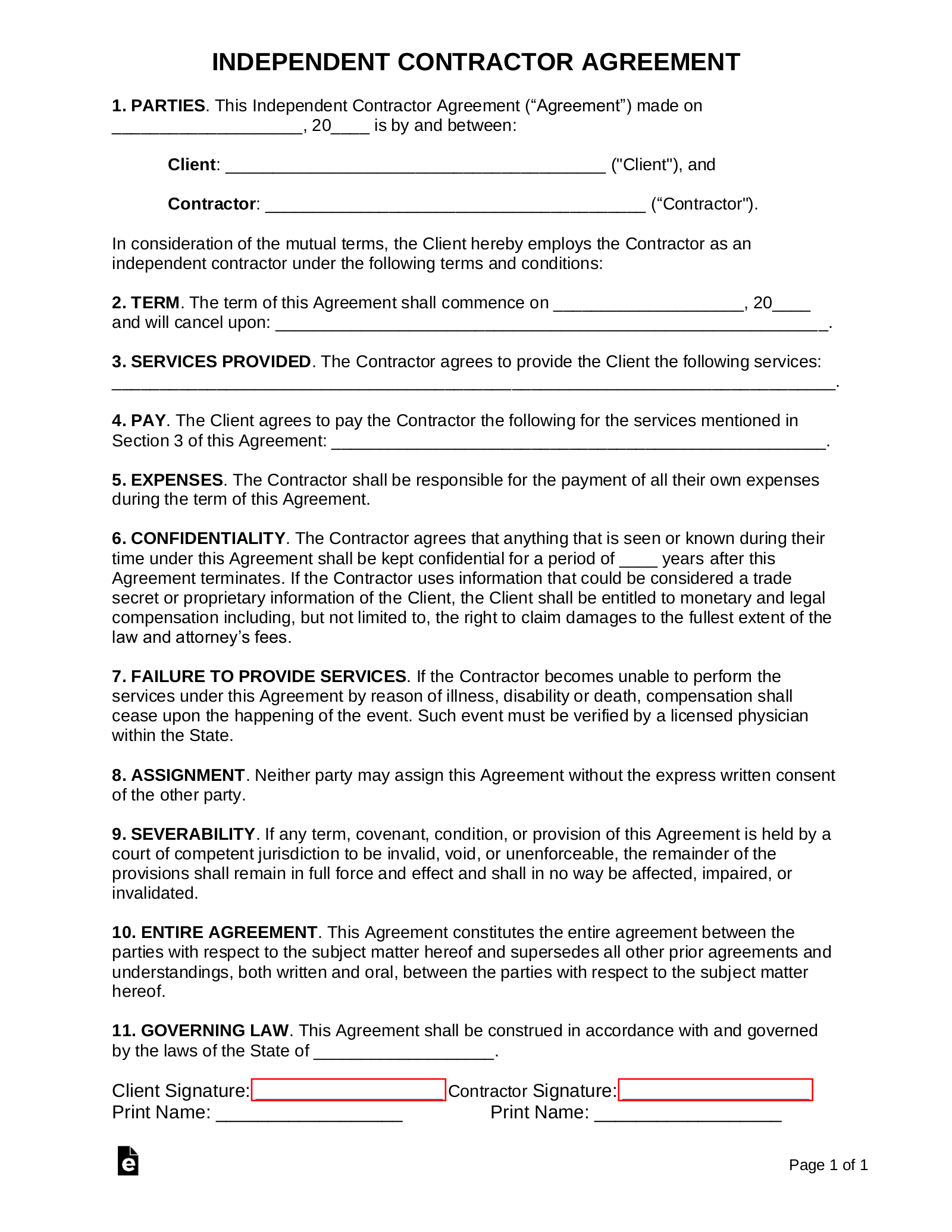

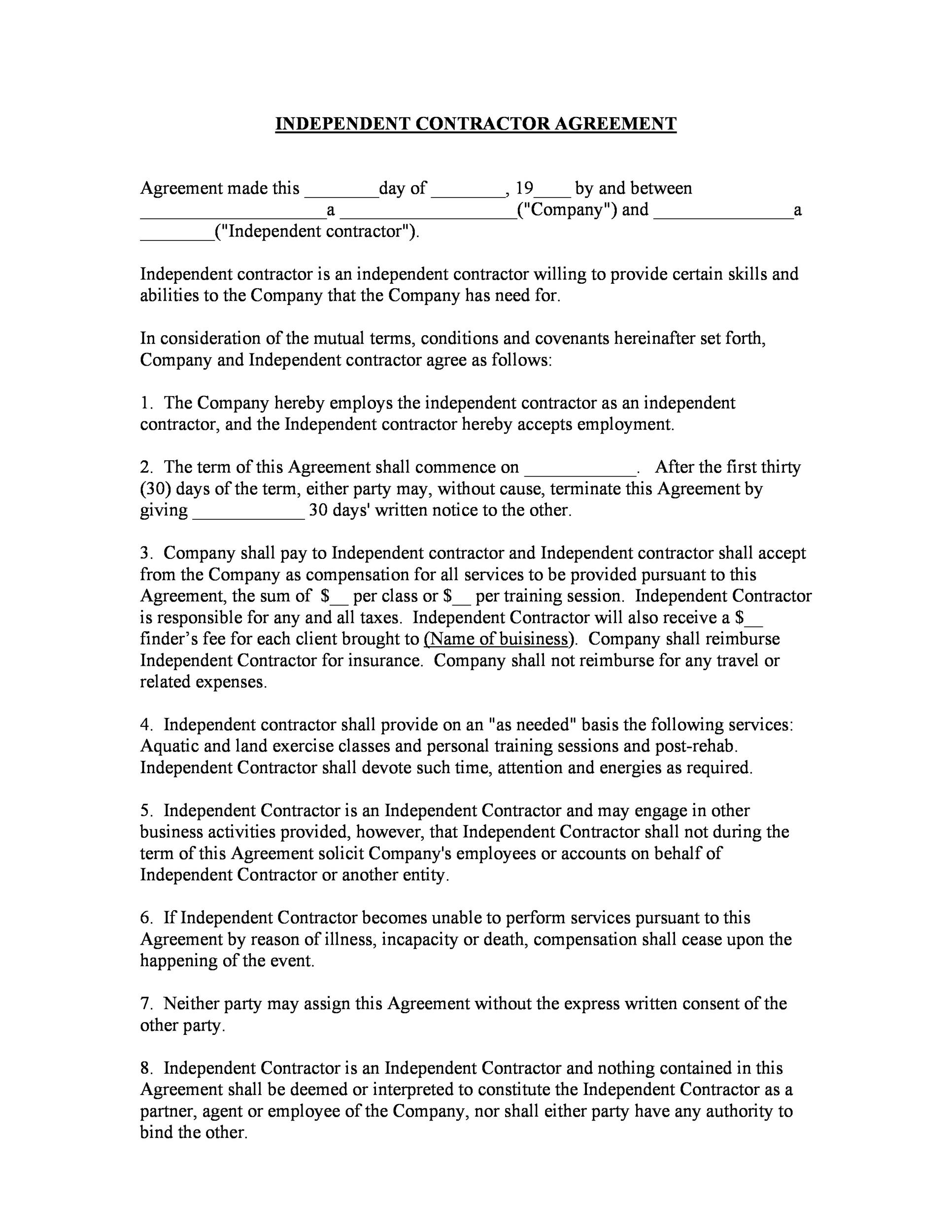

Free Independent Contractor Agreement Templates Pdf Word Eforms

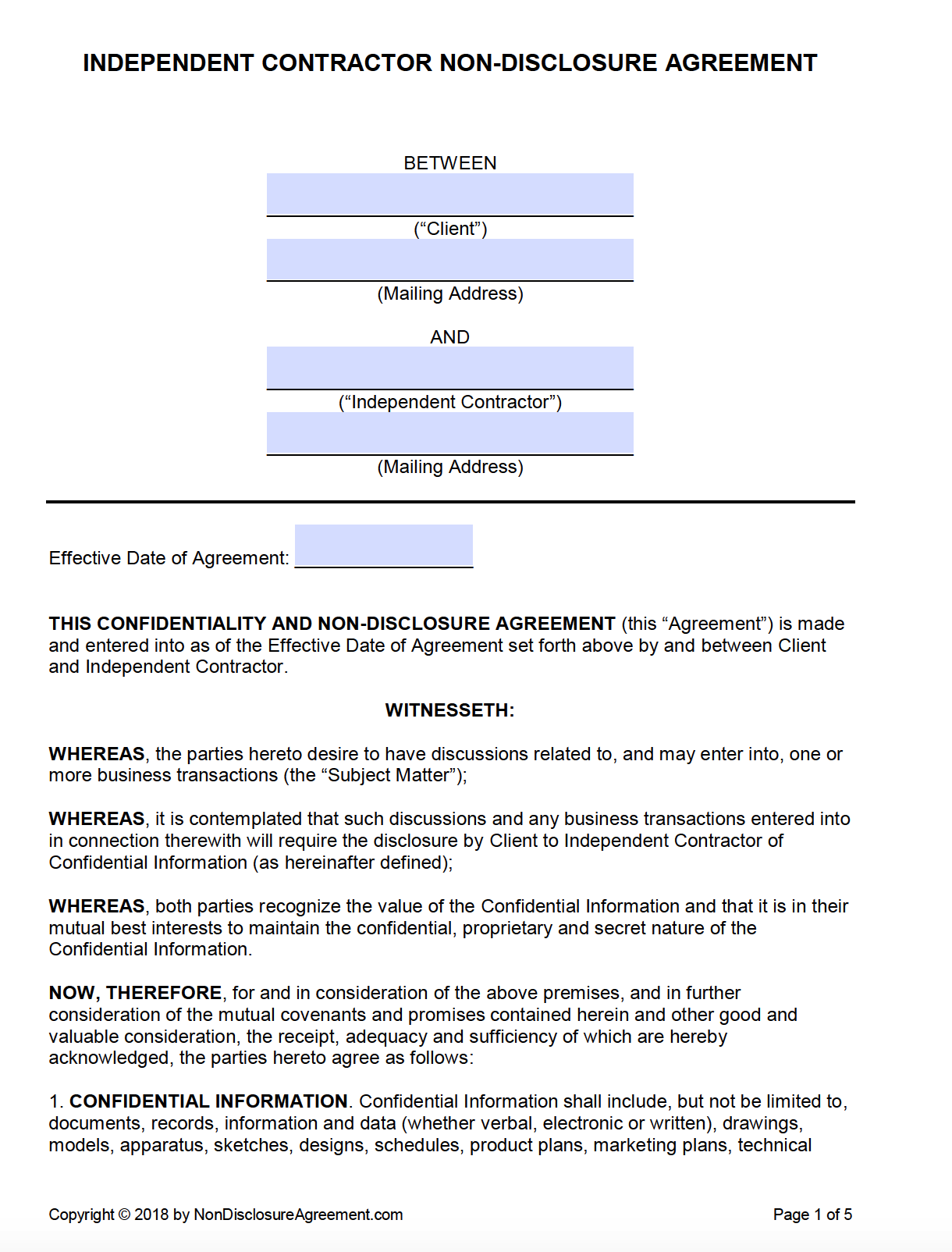

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Use a 1099 spreadsheet template (Excel or google sheets) Perhaps the best way to track your income and business expense as an independent contractor is through spreadsheets Furthermore, it is beneficial while filling out 1099misc forms Open either Excel or Google Sheets to begin the expense tracking processIndependent contractors don't work for a single employer fulltime They're rather engaged in different projects and can have multiple employers at the same time Moreover, they pay their own taxes, including health insurance and selfemployment taxes, for example Each employer they work for sends them Form 1099, which they have to fill in and return to the Independent Contractor Income Independent contractor income is compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on one of the many 1099 Forms (along with rents, royalties, and other types of income)

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

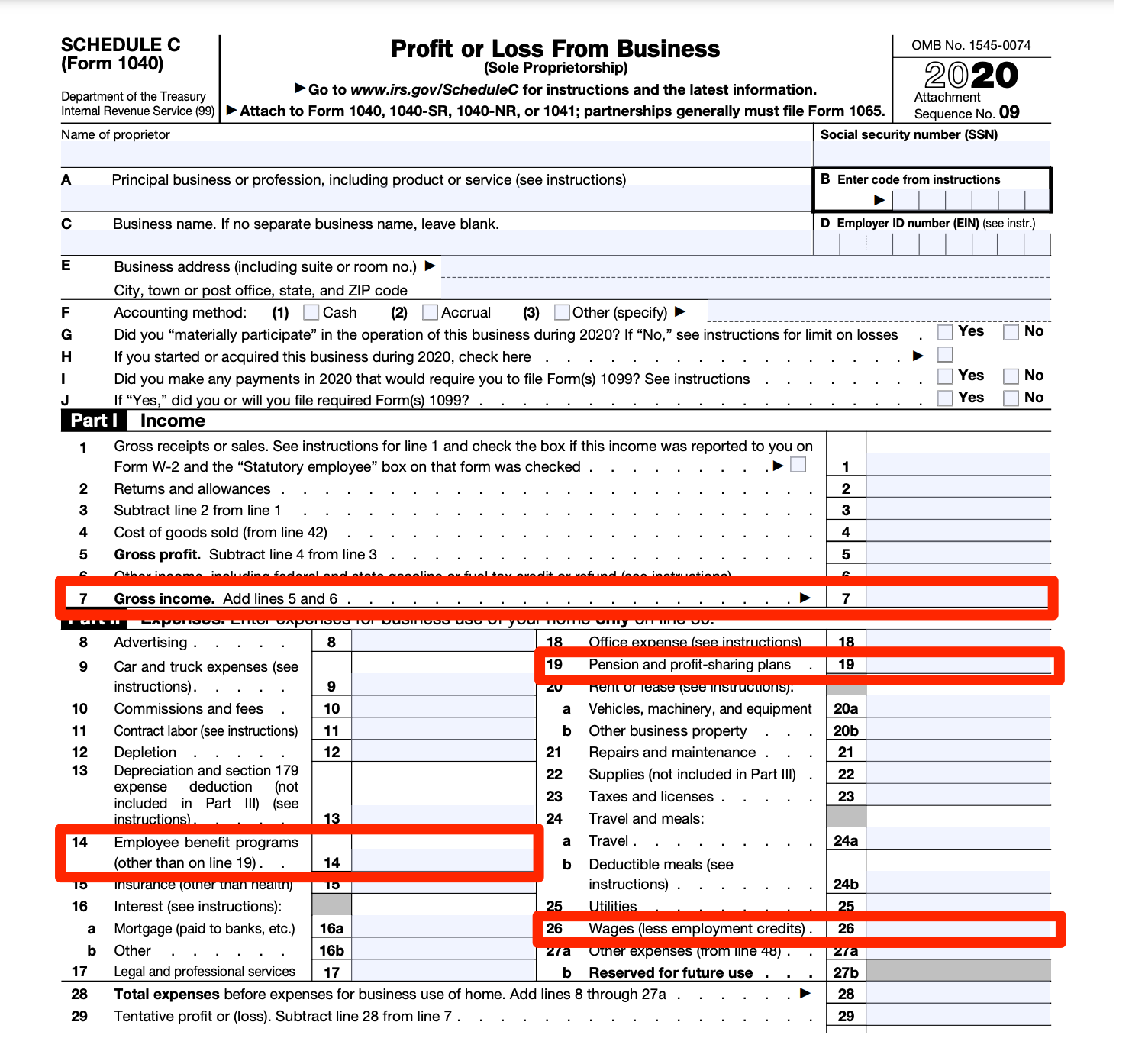

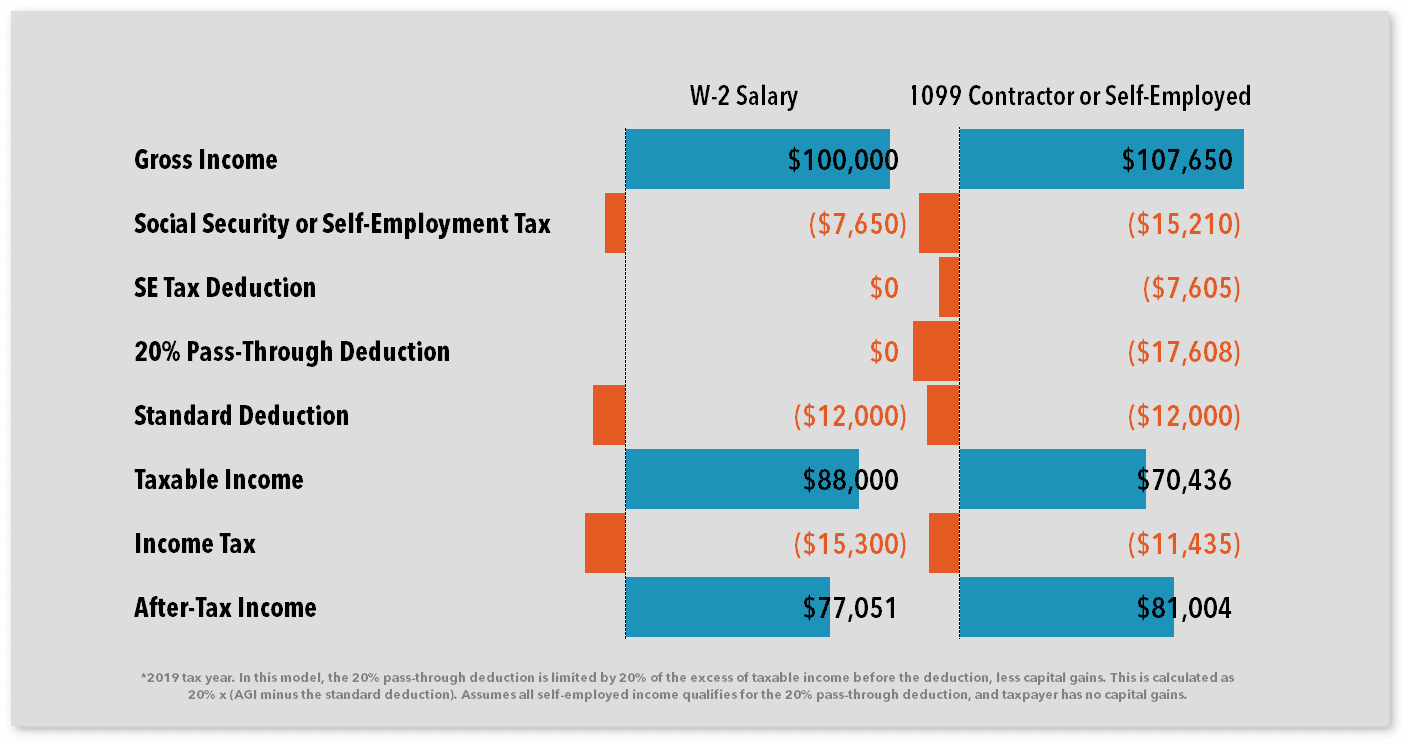

Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate For a W2 employee, the employer pays 765 percent of Medicare and Social Security taxes while the employee pays 765 percent For independent contractors who file a form 1099 at taxtime, the contractor becomes liable to pay the employer's share of these taxes, meaning that the full 153 percent comes out of each client payment the A 1099 employee is an individual who offers their services to companies and organizations as a freelancer The term "1099" refers to certain forms that an individual must complete in order to classify their work and current standing with the company as an independent contractor

When Is Tax Form 1099 Misc Due To Contractors Godaddy Blog

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Independent Contractor Income compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on Form 1099MISC or Form 1099NEC (along with rents, royalties, and other types of income) At tax time, employees should receive Form W2 from their employer If you've received a 1099 Form instead of an employee W2, your company is treating you as a selfemployed workerThis is also known as an independent contractor When there is an amount shown on your Form 1099MISC in Box 7, you're typically considered selfemployed Here are four reasons you don't want to be an independent contractor Nannies Aren't Contractors First and foremost, the IRS considers a nanny an employee, not an independent contractor Being issued a Form 1099 (miscellaneous income for independent contractors) instead of a Form W2 (wage and tax statement for employees) is illegal

1099 Form Colorado 17 Fresh Independent Contractor Employment Form Mersnoforum Models Form Ideas

50 Free Independent Contractor Agreement Forms Templates

Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)Important Facts About Employee Classification Employers are responsible for classifying workers correctly A worker who is called contract labor and whose wages are reported using IRS Form 1099 may not be an independent contractor Neither the business nor the individual may choose whether the worker is classified as a contractor or employee Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Learn More About 1099 Misc Regarding Business Expenses For Independent Contractors At Nathan Gibson S Business Expense Independent Contractor Best Tax Software

A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company How to Register With the IRS as an Independent Contractor If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on UpCounsel's Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Independent contractors & 1099 workers Misclassification is the practice of illegally classifying employees as independent contractors Misclassification is illegal regardless of whether the misclassification was intentional or due to a mistaken belief that workers are independent contractors Misclassification can also happen when an employer

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

W 9 Vs 1099 Understanding The Difference

50 Free Independent Contractor Agreement Forms Templates

1099 Misc Tax Form Diy Guide Zipbooks

Employee Versus Independent Contractor The Cpa Journal

Contract Worker Vs Employee Fountain Blog

Www Lni Wa Gov Forms Publications F212 250 000 Pdf

Form 1099 Nec Form Pros

How To Pay Tax As An Independent Contractor Or Freelancer

Do You Need To Issue A 1099 To Your Vendors Accountingprose

The Problem With A 1099 Independent Contractor Vs A W 2 Employee

Free Colorado Independent Contractor Agreement Word Pdf Eforms

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Tax Deductions For Independent Contractors Kiplinger

What Is The 1099 Form For Small Businesses A Quick Guide

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Employee Or Contractor Do You Know How To Classify Your Workers Business 2 Community

Change Is A Good Thing Hype S Talent Is All W2 Variable Hour Employees

50 Free Independent Contractor Agreement Forms Templates

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 Vs W 2 What You Don T Know Could Cost You

Changes To 1099s In Altruic Advisors

Laser Set 2 Up 1099 Misc 4 Part Hrdirect

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

How To Report Misclassification Of Employees Top Class Actions

Part Time Employees V Independent Contractors Ppt Download

Swart Baumruk Company Llp

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Independent Contractor Taxes Guide 21

5 Things To Know Before Hiring A 1099 Employee

Employee Vs Independent Contractor Apollomd

Www Irs Gov Pub Irs Tege Win03 Fslg Ng Pdf

Employee Vs Independent Contractor What S The Difference

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W2 Difference Between Independent Contractors Employees

Sfosb Org Modules Showdocument Aspx Documentid

Independent Contractor Vs Employee Explained California Law 21

1099 Tax Misc Form Form 1099 Online E File 1099 Misc Form 19 By Form1099online Issuu

What Is A 1099 Vs W 2 Employee Napkin Finance

Everything You Need To Know About Paying Contractors Wave Blog

1099 Vs W 2 How Independent Contractors And Employees Differ Northwestern Mutual

3

Employee Versus Independent Contractor The Cpa Journal

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

What Is A W 9 Form Robinhood

Salaried Employees Vs Independent Sales Reps Which Is Best For Your Global Enterprise Express Global Employment

Filing Form 1099 Misc For Your Independent Contractors

Form 1099 Nec Instructions And Tax Reporting Guide

Edd Ca Gov Pdf Pub Ctr De231y Pdf

Converting From Contractor To Employee How To

1099 Employees Everything Employers Should Know Vensurehr Blog

3

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Why You Need To Understand The Difference Between Independent Contractor Self Employed And Employee Nurse Practitioners In Business

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Vs Employee Classification With Infographic

Www Uvm Edu Policies Acct Indcontract Pdf

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Independent Contractor Employee Infographic Contractors

1

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Types Of 1099 Forms Shefalitayal

Who Should You Hire Independent Contractor Vs Employee Top Echelon

Independent Contractor Vs Employee What Can These Workers Offer Your Business Paychex

50 Free Independent Contractor Agreement Forms Templates

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Forms Do You Need To Hire An Independent Contractor Workest

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

1099 Misc Instructions And How To File Square

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

Working With Independent Contractors Business Guidelines

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Filing Taxes 1099 Forms Every Independent Contractor Should Know About Moves Financial

1099 Form Irs 18

Use Our Compliance Checklist To Minimize Contractor Risk Mbo Partners

How Can I Get A Copy Of My Tax Form Support Center

Free Independent Contractor Agreement Pdf Word

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

0 件のコメント:

コメントを投稿